Anúncios

The global shift toward sustainable finance is reshaping how investors, institutions, and governments allocate capital, prioritizing environmental responsibility alongside financial returns.

🌱 The Rise of Sustainable Finance in Modern Investment

Over the past decade, sustainable investing has evolved from a niche consideration to a mainstream investment strategy. Investors worldwide are increasingly recognizing that environmental, social, and governance (ESG) factors directly influence long-term financial performance. This transformation reflects a broader understanding that sustainable business practices create resilience, reduce risks, and unlock new opportunities in a rapidly changing global economy.

Anúncios

The convergence of climate awareness, regulatory pressure, and investor demand has catalyzed unprecedented growth in green financial instruments. Institutional investors managing trillions of dollars now integrate sustainability metrics into their decision-making processes, fundamentally altering capital flows across industries and geographies.

Market data reveals compelling trends: sustainable investment assets exceeded $35 trillion globally in recent years, representing more than one-third of professionally managed assets in major markets. This momentum shows no signs of slowing, as younger generations inherit wealth and demand investments aligned with their values, while climate-related risks become increasingly material to portfolio performance.

Anúncios

💚 Understanding Green Bonds: Finance Meets Environmental Impact

Green bonds represent a revolutionary financial instrument designed specifically to fund projects with positive environmental outcomes. These fixed-income securities raise capital exclusively for initiatives addressing climate change, renewable energy, pollution prevention, biodiversity conservation, and sustainable resource management.

The green bond market has experienced explosive growth since its inception. The first green bond was issued by the European Investment Bank in 2007, and the market has since expanded exponentially. Annual issuance now exceeds hundreds of billions of dollars, with diverse participants including governments, municipalities, corporations, and supranational organizations.

Key Characteristics of Green Bonds

Green bonds function similarly to conventional bonds but with specific requirements for fund allocation. Issuers commit to using proceeds for predetermined environmental projects and typically provide regular reporting on the use of funds and environmental impact achieved. This transparency distinguishes green bonds from traditional debt instruments and provides investors with measurable sustainability outcomes.

The Green Bond Principles, established by the International Capital Market Association, provide voluntary guidelines that recommend transparency, disclosure, and reporting. These principles cover four core components: use of proceeds, process for project evaluation and selection, management of proceeds, and reporting requirements.

Types of Projects Financed by Green Bonds

- Renewable energy generation including solar, wind, hydroelectric, and geothermal installations

- Energy efficiency improvements in buildings, industrial processes, and transportation systems

- Sustainable waste management and circular economy initiatives

- Clean transportation infrastructure including electric vehicle charging networks and public transit

- Climate change adaptation projects such as flood defenses and drought-resistant agriculture

- Biodiversity conservation and sustainable land use management

- Water management including wastewater treatment and water conservation technologies

📊 ESG Portfolios: Integrating Values with Investment Strategy

ESG portfolios represent a comprehensive approach to sustainable investing that evaluates companies and assets across environmental, social, and governance dimensions. Unlike green bonds that focus exclusively on environmental projects, ESG portfolios assess the holistic sustainability performance of investment opportunities.

The environmental component examines how organizations manage their ecological footprint, including carbon emissions, resource consumption, waste generation, and pollution. Social factors evaluate labor practices, human rights, diversity and inclusion, community relations, and customer satisfaction. Governance criteria assess corporate leadership, board composition, executive compensation, shareholder rights, and business ethics.

ESG Investment Approaches

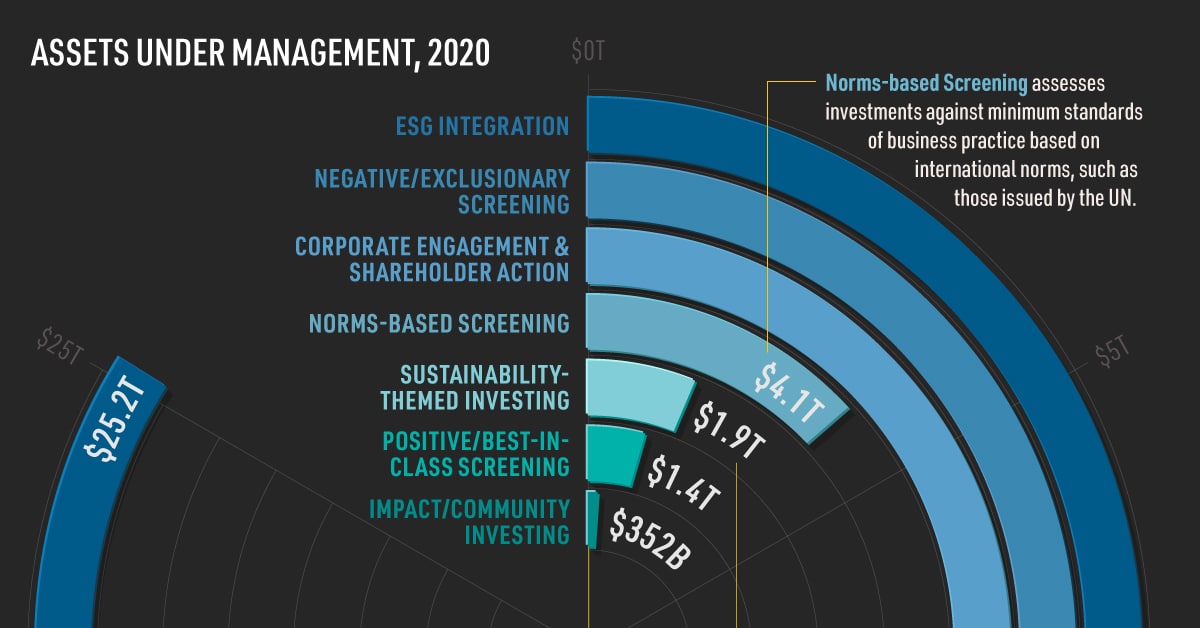

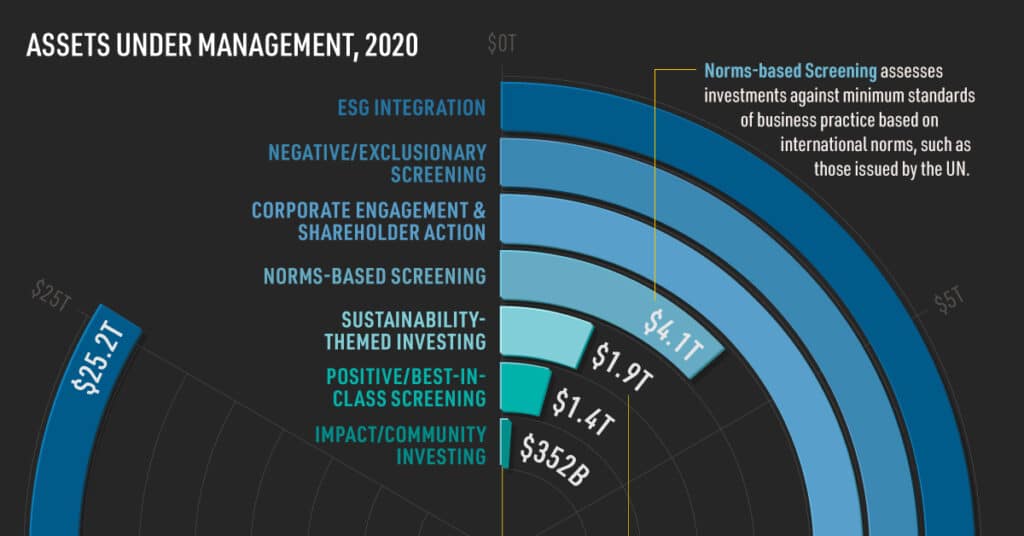

Investors employ various strategies when constructing ESG portfolios, each with distinct methodologies and objectives. Negative screening excludes companies or industries that violate specific ethical standards, such as those involved in tobacco, weapons manufacturing, or fossil fuel extraction. This approach allows investors to align their portfolios with personal values by avoiding objectionable activities.

Positive screening actively identifies and invests in companies demonstrating superior ESG performance within their sectors. This strategy rewards corporate leaders in sustainability, encouraging best practices and supporting businesses driving positive change. ESG integration systematically incorporates sustainability factors into traditional financial analysis, recognizing that these considerations materially affect risk and return profiles.

Impact investing goes further by targeting investments that generate measurable social or environmental benefits alongside financial returns. Thematic investing focuses on specific sustainability trends such as clean energy, water scarcity solutions, or sustainable agriculture, capitalizing on long-term structural shifts in the global economy.

🔍 The Financial Performance of Sustainable Investments

A common misconception suggests that sustainable investing requires sacrificing financial returns for environmental or social benefits. However, extensive research increasingly demonstrates that ESG considerations enhance rather than diminish investment performance over meaningful time horizons.

Numerous academic studies and meta-analyses have examined the relationship between ESG factors and financial outcomes. The consensus reveals that companies with strong ESG profiles typically exhibit lower cost of capital, reduced volatility, better operational performance, and superior risk-adjusted returns compared to peers with weaker sustainability credentials.

Risk Mitigation Through Sustainability

ESG analysis provides critical insights into non-financial risks that traditional metrics often overlook. Companies facing environmental liabilities, social controversies, or governance failures encounter regulatory penalties, reputational damage, operational disruptions, and legal expenses that directly impact profitability and shareholder value.

Climate-related risks exemplify how environmental factors translate into financial materiality. Physical risks from extreme weather events, water scarcity, and ecosystem degradation threaten supply chains, infrastructure, and agricultural productivity. Transition risks associated with decarbonization policies, technological disruption, and changing consumer preferences create winners and losers across industries.

Companies proactively managing these exposures through robust ESG practices demonstrate greater resilience during market turbulence. Research consistently shows that sustainable portfolios exhibit lower downside risk and volatility, particularly during periods of economic stress or market corrections.

🌍 Global Regulatory Landscape Driving Sustainable Finance

Government policies and regulatory frameworks increasingly mandate sustainability disclosure and incentivize green investments. The European Union has established the most comprehensive sustainable finance regulations, including the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy for sustainable activities.

These regulations create standardized definitions for sustainable investments, require financial institutions to disclose ESG integration practices, and impose transparency obligations throughout the investment value chain. Such frameworks reduce greenwashing, enhance comparability, and provide investors with reliable information for decision-making.

Similar initiatives are emerging globally. The United Kingdom has implemented mandatory climate-related financial disclosures for large companies and financial institutions. Japan has integrated ESG considerations into its corporate governance code. China has become the world’s largest green bond issuer, with government policies actively promoting sustainable finance to support environmental objectives.

The Role of Central Banks and Regulators

Financial regulators increasingly recognize climate change and sustainability as systemic risks requiring prudential oversight. Central banks are incorporating climate scenarios into stress testing frameworks, evaluating how financial institutions would perform under various climate futures.

The Network for Greening the Financial System, a coalition of central banks and supervisors, coordinates efforts to integrate climate and environmental risks into financial stability monitoring. These developments signal that sustainable finance considerations have moved from voluntary initiatives to core regulatory concerns affecting capital allocation and financial stability.

💡 Practical Steps for Building Sustainable Investment Portfolios

Investors interested in sustainable finance can access numerous vehicles and strategies suited to different objectives, risk tolerances, and values. The first step involves clarifying personal sustainability priorities and determining which ESG factors matter most for your investment thesis.

Investment Vehicles for Sustainable Exposure

Mutual funds and exchange-traded funds (ETFs) focusing on ESG criteria provide accessible entry points for retail investors. These vehicles offer diversification across multiple securities while maintaining sustainability standards through professional management and screening processes.

Green bond funds allow investors to gain exposure to environmental projects without selecting individual securities. These funds typically hold diversified portfolios of green bonds from various issuers, sectors, and geographies, providing liquidity and professional oversight.

Direct investment in individual green bonds or stocks of sustainable companies offers greater control but requires more research and typically larger capital commitments. This approach suits investors with specific sustainability objectives or those seeking to support particular environmental solutions.

Evaluating ESG Ratings and Data

Multiple organizations provide ESG ratings and research, including MSCI, Sustainalytics, S&P Global, and ISS ESG. These providers assess companies using proprietary methodologies that aggregate data on numerous sustainability indicators into overall scores or ratings.

However, investors should understand that ESG rating methodologies vary significantly across providers, sometimes producing divergent assessments of the same company. This reflects differences in data sources, indicator selection, weighting schemes, and scoring approaches rather than inherent flaws in ESG analysis.

Effective ESG investment requires examining underlying data and methodologies rather than relying solely on aggregate scores. Investors should consider which specific ESG factors are most material to particular industries and how companies manage those exposures relative to peers.

🚀 Innovation and Future Trends in Sustainable Finance

The sustainable finance landscape continues evolving rapidly with new instruments, technologies, and approaches expanding investment opportunities. Sustainability-linked bonds represent an innovative variation where interest rates adjust based on the issuer’s achievement of predetermined ESG targets, creating financial incentives for corporate sustainability performance.

Social bonds have gained prominence, particularly following pandemic-related economic disruptions, funding projects addressing social challenges such as affordable housing, healthcare access, education, and employment generation. These instruments apply green bond principles to social objectives, expanding sustainable finance beyond environmental concerns.

Technology Enabling Sustainable Investment

Digital technologies are transforming how investors access ESG data and construct sustainable portfolios. Artificial intelligence and machine learning analyze vast datasets from corporate disclosures, news sources, satellite imagery, and alternative data to assess sustainability performance in real-time.

Blockchain technology offers potential for enhanced transparency in green bond proceeds tracking, enabling investors to verify that funds reach intended environmental projects. Tokenization could democratize access to sustainable investments by enabling fractional ownership of assets previously accessible only to institutional investors.

Emerging Market Opportunities

Developing economies present substantial sustainable investment opportunities as they build infrastructure, expand energy systems, and modernize economies. These markets face enormous sustainable development challenges but also offer potentially higher returns alongside meaningful environmental and social impact.

Green bonds in emerging markets fund critical renewable energy projects, sustainable transportation systems, and climate adaptation infrastructure. While these investments may carry additional risks, they provide essential capital for the global transition to sustainable development while offering portfolio diversification benefits.

🎯 Addressing Greenwashing and Ensuring Authenticity

As sustainable investing has gained popularity, concerns about greenwashing have intensified. Greenwashing occurs when organizations exaggerate or misrepresent their environmental credentials or the sustainability attributes of financial products, misleading investors seeking genuine impact.

Regulatory initiatives increasingly target greenwashing through enhanced disclosure requirements, standardized definitions, and enforcement actions. The EU Taxonomy establishes technical screening criteria that activities must meet to qualify as environmentally sustainable, creating objective standards that reduce subjective interpretation.

Investors can mitigate greenwashing risks by demanding detailed reporting on sustainability outcomes, examining third-party certifications and verifications, and questioning vague environmental claims lacking specific metrics or targets. Independent verification of green bond proceeds and impact reporting provides additional assurance of authenticity.

🌟 Creating Lasting Impact Through Sustainable Investment

The transition to a sustainable global economy requires mobilizing trillions of dollars toward environmental solutions, renewable infrastructure, and regenerative business models. Sustainable investments channel capital to where it can generate both financial returns and measurable positive impact on pressing global challenges.

Individual investors increasingly recognize their agency in shaping corporate behavior and economic systems through investment decisions. Portfolio allocations send powerful signals to companies and industries about investor expectations, influencing corporate strategy, capital allocation, and business practices.

Collective action through sustainable investing creates market-based incentives rewarding environmental responsibility and penalizing unsustainable practices. As more capital flows toward sustainable opportunities, the cost of capital for green projects decreases while brown industries face higher financing costs, accelerating the economic transition.

Green bonds and ESG portfolios represent complementary approaches within the broader sustainable finance ecosystem. Green bonds provide targeted financing for specific environmental projects with transparent impact reporting. ESG portfolios offer comprehensive sustainability integration across diverse asset classes and investment strategies.

Together, these instruments empower investors to align financial objectives with environmental values, contributing to a more sustainable and resilient global economy. The continued growth and maturation of sustainable finance markets promises expanding opportunities for investors seeking both competitive returns and positive planetary impact.

The journey toward sustainable investing requires ongoing education, critical evaluation of claims, and commitment to long-term thinking beyond quarterly results. As climate change accelerates and environmental challenges intensify, sustainable investment strategies increasingly represent not just ethical choices but financially prudent responses to material risks and opportunities shaping the future economy.