Anúncios

Venture capital is revolutionizing how groundbreaking technologies move from laboratory concepts to world-changing innovations, particularly in the deep tech sector.

🚀 The Deep Tech Revolution: Where Science Meets Capital

Deep tech represents a fundamental shift in how we approach innovation. Unlike traditional software startups that can pivot quickly and scale rapidly, deep tech ventures are built on substantial scientific discoveries and engineering breakthroughs. These companies are developing quantum computers, advanced materials, artificial intelligence systems, biotechnology solutions, and aerospace technologies that promise to reshape entire industries.

Anúncios

The relationship between venture capital and deep tech has evolved dramatically over the past decade. Previously, venture capitalists favored quick returns and scalable software models. Today, a growing number of specialized funds recognize that the most transformative innovations require patient capital, technical expertise, and a willingness to navigate longer development cycles.

This shift didn’t happen by accident. The convergence of several factors created the perfect environment for deep tech investment: declining costs of prototyping and experimentation, increased computing power, access to vast datasets, and a generation of founders combining scientific expertise with entrepreneurial ambition.

Anúncios

💡 Understanding the Deep Tech Landscape

Deep tech encompasses technologies founded on tangible engineering innovation or scientific advances. These aren’t incremental improvements to existing products but rather fundamental breakthroughs that can create entirely new markets or revolutionize existing ones.

The sector includes several key areas where venture capital is making significant impacts. Quantum computing stands at the forefront, with companies developing processors that could solve problems currently impossible for classical computers. Biotechnology firms are engineering novel therapeutics and diagnostic tools that personalize medicine. Advanced materials startups are creating substances with properties never before seen in nature.

Artificial intelligence and machine learning, while sometimes categorized separately, represent crucial deep tech domains when applied to complex problems requiring genuine innovation rather than simple application of existing algorithms. Robotics, space technology, nuclear fusion, and advanced manufacturing round out this diverse ecosystem.

The Timeline Challenge

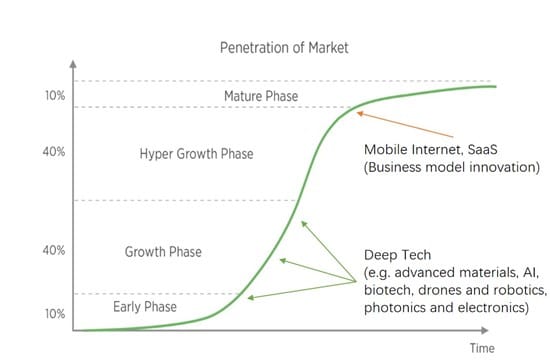

One distinguishing characteristic of deep tech ventures is their extended development timelines. Where a social media app might reach millions of users within months, a quantum computing company might spend five to ten years developing its first commercial product. This reality fundamentally changes the investment equation.

Traditional venture capital operates on relatively predictable timelines. Seed funding leads to Series A within 18-24 months, followed by subsequent rounds every 12-18 months until an exit event occurs within seven to ten years. Deep tech disrupts this model entirely.

Smart venture capitalists in this space have adapted their expectations and fund structures accordingly. They’ve created vehicles with longer investment horizons, reserved capital for multiple follow-on rounds, and developed expertise in evaluating scientific progress rather than just market traction.

🔬 How Venture Capital Fuels Deep Tech Breakthroughs

The role of venture capital in deep tech extends far beyond simply providing money. The most effective investors bring strategic value that accelerates innovation in multiple ways.

Bridging the Valley of Death

Every deep tech company faces what researchers call the “valley of death”—that perilous gap between initial research funding and commercial viability. Government grants and academic resources can fund early research, while corporate partnerships might support late-stage development, but the middle ground often lacks adequate funding sources.

Venture capital fills this critical gap. By providing substantial funding during the development phase, investors enable companies to build prototypes, conduct experiments, hire specialized talent, and iterate on their technology without the immediate pressure of generating revenue.

This patience is strategic, not charitable. Investors understand that the companies solving the hardest problems often create the most defensible competitive advantages. A breakthrough in fusion energy or quantum computing could generate returns that dwarf those from incremental software innovations.

Network Effects and Strategic Connections

Leading venture capital firms provide more than capital—they offer access to networks that can accelerate development and commercialization. These connections include potential customers, manufacturing partners, regulatory experts, and talent pools.

For a biotechnology company developing a novel therapeutic, investor connections to pharmaceutical companies, clinical research organizations, and regulatory consultants can shave years off the development timeline. For an advanced materials startup, introductions to manufacturing facilities and potential industrial customers transform laboratory curiosities into commercial products.

The best investors also facilitate knowledge sharing between portfolio companies. A lesson learned about navigating regulatory approval in one company can benefit others facing similar challenges. Technical insights about scaling manufacturing or managing intellectual property become shared resources across the portfolio.

📊 The Economics of Deep Tech Investment

Understanding the financial dynamics of deep tech venture capital reveals why this sector attracts increasingly sophisticated investors despite its challenges.

Deep tech investments typically require larger initial capital commitments than traditional startups. Where a software company might raise $2-5 million in seed funding, a quantum computing or biotechnology venture might need $10-20 million to reach meaningful milestones. This capital intensity means fewer portfolio companies per fund but potentially larger outcomes.

The risk-reward profile differs significantly from consumer technology investments. Failure rates remain high, and many deep tech ventures fail not because of poor execution but because the underlying science proves more challenging than anticipated. However, successes can be spectacular, creating not just profitable companies but entirely new industries.

Portfolio Construction Strategies

Sophisticated deep tech venture capital funds employ distinct portfolio construction strategies compared to traditional VC funds. They typically make fewer but larger investments, maintain higher reserve ratios for follow-on funding, and diversify across different technological domains rather than focusing on a single sector.

Some funds specialize in specific deep tech areas, building genuine technical expertise that helps them evaluate opportunities and add strategic value. Others take a broader approach, betting on multiple transformative technologies while relying on advisory boards of scientific experts for due diligence.

The most successful funds balance patience with accountability. They establish clear technical milestones that demonstrate scientific progress even before commercial traction becomes possible. These milestones—proving a concept in laboratory conditions, achieving specific performance metrics, or securing key partnerships—provide intermediate validation points.

🌟 Case Studies: Venture Capital Success Stories in Deep Tech

Real-world examples illustrate how venture capital funding translates into breakthrough innovations across different deep tech domains.

Quantum Computing’s Rapid Advancement

Quantum computing companies have attracted billions in venture capital over the past decade. These investments funded the development of different qubit technologies, cryogenic systems, error correction algorithms, and control systems necessary for practical quantum computers.

Companies in this space have progressed from academic concepts to commercially available quantum processing units accessible via cloud platforms. While universal quantum computers remain years away, intermediate applications in optimization, drug discovery, and materials science are already generating revenue, validating investor thesis and funding continued development.

Biotechnology’s Transformation

Venture capital has revolutionized biotechnology by funding novel approaches to drug discovery, diagnostics, and therapeutics. Companies leveraging artificial intelligence for molecule design, developing mRNA therapeutics, or creating personalized cancer treatments all required substantial venture funding to move from concept to clinical reality.

The speed at which COVID-19 vaccines were developed demonstrated the power of well-funded biotech innovation. Companies with years of venture-backed research into mRNA technology could rapidly adapt their platforms to address the pandemic, validating both the technology and the investment approach.

Space Technology’s Commercial Renaissance

Perhaps no sector better illustrates venture capital’s impact on deep tech than commercial space. Private funding transformed space access from an exclusively governmental domain into a thriving commercial ecosystem.

Venture capital enabled companies to develop reusable rockets, satellite constellations, lunar landers, and space manufacturing capabilities. These investments created new industries around space-based internet, Earth observation, and eventually space tourism and resource extraction.

🎯 Overcoming Challenges in Deep Tech Investment

Despite growing enthusiasm, deep tech venture capital faces significant challenges that investors and entrepreneurs must navigate carefully.

Technical Risk Assessment

Evaluating deep tech opportunities requires different skills than assessing traditional startups. Investors need technical expertise to distinguish genuine breakthroughs from incremental improvements or, worse, impossible claims.

Leading funds address this challenge by recruiting partners with scientific backgrounds, building advisory networks of domain experts, and developing frameworks for evaluating technical risk alongside market and execution risk. They ask probing questions about fundamental physics, chemistry, or biology rather than just business model and go-to-market strategy.

Regulatory Navigation

Many deep tech innovations face complex regulatory environments. Biotechnology products require clinical trials and regulatory approval. Advanced nuclear technologies must satisfy safety regulations. Aerospace innovations need certification from aviation authorities.

Smart investors anticipate these challenges and help portfolio companies develop regulatory strategies early. They facilitate connections to regulatory experts, fund compliance activities, and factor approval timelines into investment theses and funding plans.

Talent Acquisition and Retention

Deep tech companies compete for scarce specialized talent. Finding scientists and engineers with the right combination of technical expertise and willingness to work in a startup environment remains challenging.

Venture capital helps by providing resources for competitive compensation, funding academic partnerships that create talent pipelines, and building company cultures that attract mission-driven individuals excited about solving hard problems.

🔮 The Future of Venture Capital in Deep Tech

The relationship between venture capital and deep tech innovation continues evolving, with several trends shaping the future landscape.

Fund sizes are increasing as investors recognize that deep tech requires more capital over longer periods. Specialized funds focusing exclusively on deep tech domains are emerging alongside generalist funds adding dedicated deep tech practices. Corporate venture arms are becoming more active, bringing industry expertise and potential customers alongside capital.

Geographic diversification is expanding beyond traditional hubs. While Silicon Valley, Boston, and a few other regions dominated early deep tech investment, new centers are emerging globally as governments recognize the strategic importance of these technologies and create supportive ecosystems.

Government Collaboration Models

Public-private partnerships are becoming more sophisticated. Governments provide early-stage research funding, de-risk technologies through procurement commitments, and create regulatory frameworks that enable innovation. Venture capital then funds commercialization and scaling.

This complementary relationship leverages the strengths of both sectors—public funding for basic research and risk tolerance for technologies with uncertain timelines, private capital for commercial development and market discipline.

New Investment Instruments

Traditional equity investments are being supplemented by new structures better suited to deep tech. Revenue-based financing, milestone-based funding, and hybrid debt-equity instruments provide flexibility for companies with long development timelines but clear technical milestones.

Some funds are experimenting with different carried interest structures that reward longer holding periods, aligning incentives between fund managers and the extended timelines of deep tech investments.

🎓 Building the Deep Tech Ecosystem

Successful deep tech innovation requires more than just capital and technology—it needs a complete ecosystem of supporting elements.

Universities and research institutions provide the foundational research and talent pipeline. Government agencies offer research grants, procurement contracts, and regulatory frameworks. Manufacturing partners enable scaling from prototypes to production. Industry partners provide market validation and distribution channels.

Venture capital plays a coordinating role, connecting these ecosystem elements while providing the funding that transforms research into products. The most successful deep tech regions cultivate all these elements simultaneously rather than focusing exclusively on any single component.

💪 Why Deep Tech Matters Now More Than Ever

The urgency around deep tech investment reflects growing recognition that humanity faces challenges requiring fundamental technological breakthroughs, not just incremental improvements.

Climate change demands innovations in energy generation, storage, and transmission. Quantum computing and advanced materials could revolutionize these domains. An aging global population needs biotechnology innovations that extend healthspan and treat previously incurable diseases. Food security requires agricultural technologies that increase yields while reducing environmental impact.

These challenges represent enormous markets—potentially trillions of dollars—but more importantly, they’re essential for human flourishing. Venture capital’s role in funding solutions creates both financial returns and positive societal impact, a combination increasingly important to investors and entrepreneurs alike.

The transformation of venture capital from a sector primarily focused on software and consumer technologies to one increasingly engaged with fundamental scientific breakthroughs represents a maturation of the innovation economy. As more investors develop the expertise, patience, and capital structures necessary for deep tech, the pace of breakthrough innovations accelerates.

For entrepreneurs working on hard problems at the intersection of science and commerce, this environment offers unprecedented opportunities. The capital is available, the networks exist, and the market hunger for transformative solutions continues growing. For investors willing to develop deep technical expertise and embrace longer timelines, deep tech offers the possibility of backing companies that don’t just create wealth but genuinely change the world.

The partnership between venture capital and deep tech innovation is still young, but its impact is already evident in quantum computers moving from theory to commercial reality, biotechnology treatments curing previously fatal diseases, and private spacecraft reaching orbit. As this partnership matures and more capital flows into fundamental innovation, the next decade promises breakthroughs that today seem like science fiction but tomorrow will be business reality.