Anúncios

Central Bank Digital Currencies are reshaping the financial landscape, promising to revolutionize how we transact, save, and interact with money in an increasingly digital world. 💰

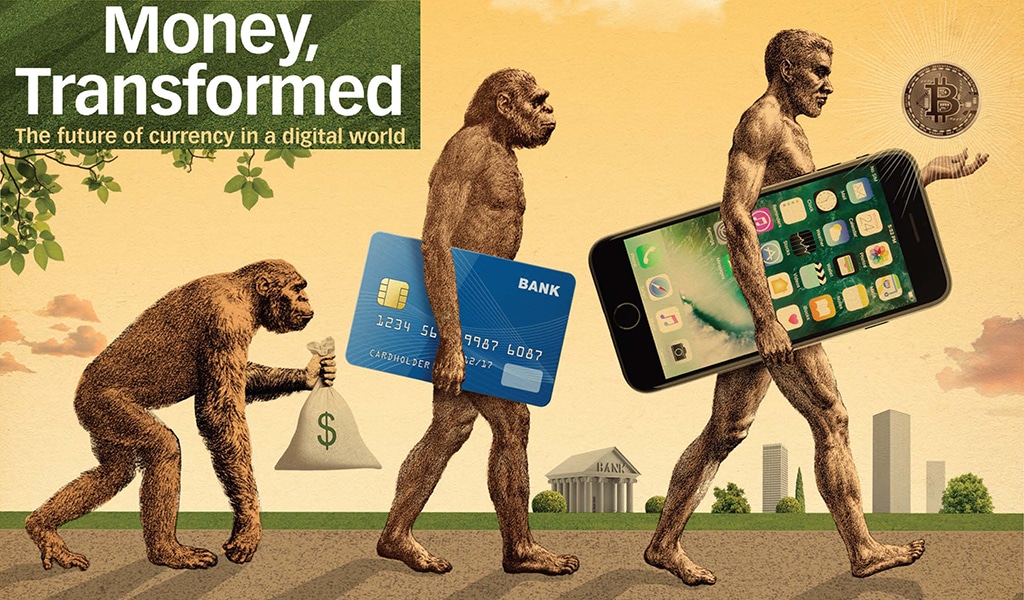

The concept of money has evolved dramatically throughout human history, from bartering systems to precious metals, paper currency, and now digital transactions. We stand at the precipice of perhaps the most significant transformation yet: the widespread adoption of Central Bank Digital Currencies (CBDCs). As central banks worldwide experiment with and implement these digital versions of fiat currency, the implications for global finance, economic policy, and everyday transactions are profound and far-reaching.

Anúncios

Understanding CBDCs requires us to look beyond the cryptocurrency hype and examine how sovereign nations are responding to the digitalization of money. Unlike decentralized cryptocurrencies such as Bitcoin or Ethereum, CBDCs represent government-backed digital currencies that maintain the stability and regulatory oversight of traditional fiat money while leveraging the technological advantages of digital assets.

🌐 The CBDC Revolution: Understanding the Fundamentals

Central Bank Digital Currencies represent a digitized form of a country’s official currency, issued and regulated by the nation’s central bank. Unlike the physical cash in your wallet or the numbers in your bank account (which are actually commercial bank money), CBDCs are direct liabilities of the central bank, similar to physical banknotes but existing entirely in digital form.

Anúncios

The architecture of CBDCs can vary significantly depending on design choices made by issuing authorities. Some models propose retail CBDCs accessible directly to citizens and businesses, while others envision wholesale CBDCs designed primarily for interbank settlements and large financial institutions. This flexibility in design allows countries to tailor their digital currencies to specific economic needs and technological capabilities.

The motivation behind CBDC development stems from multiple factors. Central banks recognize the declining use of physical cash, particularly accelerated by the COVID-19 pandemic. They also seek to maintain monetary sovereignty in an era of private digital currencies and stablecoins that could potentially undermine traditional monetary policy tools. Additionally, CBDCs offer opportunities to enhance financial inclusion, reduce transaction costs, and improve the efficiency of cross-border payments.

Key Characteristics That Define CBDCs

Several fundamental characteristics distinguish CBDCs from other forms of digital money. First, they carry the full faith and credit of the issuing government, providing stability that volatile cryptocurrencies cannot match. Second, CBDCs are programmable, potentially enabling smart contract functionality and conditional payments. Third, they offer varying degrees of anonymity and privacy, balancing individual rights with regulatory requirements for anti-money laundering and counter-terrorism financing.

The technological infrastructure supporting CBDCs can range from distributed ledger technology (DLT) to centralized databases, depending on the specific implementation. This technological flexibility allows central banks to choose systems that best align with their existing infrastructure, security requirements, and scalability needs.

🚀 Global Adoption: Who’s Leading the Digital Currency Race?

The race to develop and implement CBDCs has become a defining feature of modern monetary policy, with nations at various stages of exploration, development, and deployment. China has emerged as the clear frontrunner with its digital yuan (e-CNY), having conducted extensive pilot programs in multiple cities involving millions of users and billions of dollars in transactions.

The Bahamas became the first country to fully launch a CBDC with the Sand Dollar in October 2020, designed specifically to improve financial inclusion across its archipelago of islands. Nigeria followed with the eNaira in 2021, targeting both domestic financial inclusion and facilitating diaspora remittances. These early adopters provide valuable case studies for other nations considering similar initiatives.

In Europe, the European Central Bank is actively developing the digital euro, with a formal investigation phase launched in 2021 and potential implementation targeted for later this decade. The Bank of England is exploring a “digital pound,” while Sweden’s Riksbank has been testing the e-krona since 2020, motivated by the country’s rapid move toward cashless transactions.

The Americas: Cautious Exploration and Strategic Positioning

The United States Federal Reserve has taken a more measured approach, conducting extensive research and public consultation on a potential digital dollar. The Fed’s cautious stance reflects concerns about privacy, cybersecurity, and the potential impact on the existing banking system. However, the geopolitical implications of falling behind in CBDC development, particularly relative to China, have intensified discussions about accelerating American efforts.

Latin American nations are exploring CBDCs with varying degrees of urgency, often motivated by unique regional challenges such as currency instability, high remittance flows, and significant unbanked populations. Brazil’s central bank has announced plans for a digital real, while other countries in the region are conducting feasibility studies.

💡 Transformative Potential: How CBDCs Could Reshape Finance

The implementation of CBDCs carries profound implications for how money functions in society. One of the most significant potential benefits lies in financial inclusion. Approximately 1.7 billion adults worldwide remain unbanked, lacking access to formal financial services. CBDCs could provide these individuals with direct access to central bank money through mobile devices, bypassing the need for traditional bank accounts and their associated costs and requirements.

Cross-border payments represent another area ripe for transformation. Current international transfer systems are often slow, expensive, and opaque, with multiple intermediaries extracting fees along the way. CBDCs designed with interoperability in mind could enable near-instantaneous international transactions at minimal cost, revolutionizing global trade and remittance flows.

Monetary policy transmission could become more direct and efficient with CBDCs. Central banks could potentially implement negative interest rates more effectively, distribute stimulus payments directly to citizens, or even program money with expiration dates to encourage spending during economic downturns. These capabilities would provide unprecedented tools for economic management, though they also raise important questions about government overreach.

Enhanced Transparency and Reduced Crime

The digital nature of CBDCs offers enhanced traceability compared to physical cash, potentially reducing tax evasion, money laundering, and terrorist financing. Every transaction could be recorded and, depending on design choices, made visible to regulatory authorities. This transparency could significantly strengthen efforts to combat financial crimes while ensuring compliance with international standards.

However, this same characteristic raises serious privacy concerns. Finding the appropriate balance between transparency for regulatory purposes and privacy for individual citizens represents one of the central challenges in CBDC design. Different nations are approaching this balance differently, reflecting varying cultural attitudes toward privacy and government oversight.

⚠️ Critical Challenges: Navigating the Risks and Concerns

Despite their potential benefits, CBDCs present significant challenges and risks that must be carefully managed. Cybersecurity stands as perhaps the most critical concern. A successful attack on a CBDC system could compromise the entire monetary system, potentially affecting millions of users and billions in value. The centralized nature of many CBDC designs creates attractive targets for sophisticated cyber attackers, necessitating robust security measures.

The risk of bank disintermediation poses a substantial challenge to the existing financial system. If CBDCs become too attractive as a store of value, depositors might move funds from commercial banks to central bank accounts, potentially destabilizing the banking sector and reducing the funds available for lending. This could constrain credit creation and economic growth unless carefully managed through design features like holding limits or tiered interest rates.

Privacy concerns extend beyond simple surveillance fears. The potential for governments to monitor all financial transactions, freeze accounts instantly, or program restrictions on how money can be spent raises dystopian possibilities. While these capabilities might be justified for preventing crime, they also create opportunities for authoritarian abuse, particularly in countries with weak democratic institutions.

Technical and Operational Complexities

The technical infrastructure required to support a national CBDC presents enormous challenges. Systems must be capable of handling millions or billions of transactions with high reliability, minimal latency, and strong resilience against failures or attacks. Achieving this at scale while maintaining cost-effectiveness requires sophisticated technology and careful architectural decisions.

Interoperability between different national CBDCs poses another significant challenge. Without international coordination and common standards, CBDCs could become fragmented, limiting their utility for cross-border transactions and potentially creating new inefficiencies rather than solving existing ones. Ongoing international collaboration through organizations like the Bank for International Settlements is crucial for addressing these concerns.

🌍 Geopolitical Implications: CBDCs and Global Power Dynamics

The development of CBDCs extends far beyond technical monetary considerations, carrying significant geopolitical ramifications. China’s leadership in CBDC development is widely viewed as part of a broader strategy to internationalize the yuan and challenge the dollar’s dominance in global finance. A widely adopted digital yuan could facilitate trade and investment flows that bypass the dollar-based international payment systems, potentially weakening U.S. economic influence.

The current international monetary system relies heavily on the U.S. dollar, with the SWIFT payment network serving as critical infrastructure for global finance. This gives the United States significant power through sanctions and financial surveillance capabilities. CBDCs designed with cross-border functionality could provide alternatives to this system, redistributing geopolitical power in the process.

Developing nations face particular considerations regarding CBDCs. While these technologies offer opportunities to leapfrog traditional financial infrastructure, they also risk increasing dependence on foreign technology providers and exposing currencies to new forms of competitive pressure. The digital divide could be exacerbated if wealthier nations implement superior CBDC systems that attract capital and talent away from developing economies.

🔮 Looking Ahead: The Future Landscape of Digital Money

The trajectory of CBDC development suggests we are moving toward a hybrid monetary system where digital central bank money coexists with traditional cash, commercial bank deposits, and possibly private digital currencies. This pluralistic approach may prove optimal, providing choice while maintaining stability and regulatory oversight.

The next decade will likely see increasing numbers of countries implementing CBDCs, with early adopters providing lessons that inform later implementations. International coordination on standards and interoperability will become increasingly important as more systems come online. Organizations like the International Monetary Fund and the Bank for International Settlements will play crucial roles in facilitating this cooperation.

Innovation in CBDC design will continue as countries experiment with different models and features. We may see the emergence of programmable money with sophisticated smart contract capabilities, CBDCs designed specifically for wholesale versus retail use, and systems that integrate with emerging technologies like the Internet of Things to enable machine-to-machine payments.

Preparing for the Digital Currency Era

Businesses, financial institutions, and individuals should begin preparing for the CBDC era. Financial institutions need to consider how their business models might need to adapt as central bank digital currencies become available. Businesses should explore how CBDCs might improve their operations through reduced transaction costs, faster settlements, and new payment capabilities.

For individuals, understanding CBDCs and their implications will become increasingly important as these systems roll out. Questions about privacy, security, and how to manage digital money will require financial literacy adapted to this new monetary landscape. Educational initiatives will be crucial for ensuring broad understanding and acceptance of these technologies.

🎯 Strategic Implications for Different Stakeholders

Central banks face the delicate task of designing CBDCs that achieve policy objectives without destabilizing existing financial systems. They must balance innovation with prudence, moving quickly enough to remain relevant while avoiding catastrophic mistakes. The decisions made in these early stages will shape monetary systems for generations.

Commercial banks must adapt to a world where they face competition from central banks themselves. This may require refocusing on services where they maintain advantages, such as lending, investment advice, and specialized financial products. Banks that successfully navigate this transition will likely emerge with more diversified business models and stronger customer relationships.

Technology companies see CBDCs as both opportunity and threat. While implementation creates demand for technical expertise, central bank digital currencies could reduce the payments business opportunities that tech giants have been pursuing. The relationship between public sector CBDCs and private sector innovation will significantly influence the digital economy’s evolution.

The rise of Central Bank Digital Currencies represents one of the most significant financial innovations in modern history, with the potential to fundamentally reshape how money functions in society. As nations worldwide advance their CBDC initiatives, we are witnessing the emergence of a new monetary paradigm that combines the stability of government-backed currency with the efficiency and innovation of digital technology. The success of this transformation will depend on thoughtful design, robust security, international cooperation, and careful attention to the balance between innovation and stability. While challenges remain substantial, the potential benefits for financial inclusion, payment efficiency, and monetary policy effectiveness make CBDCs a development that will define the financial landscape for decades to come. 🌟