Anúncios

Mobile banking has revolutionized how millions access financial services, breaking down traditional barriers and creating unprecedented opportunities for economic empowerment worldwide.

📱 The Mobile Banking Revolution Transforming Lives

The financial landscape has undergone a dramatic transformation over the past decade. Where physical bank branches once dominated the industry, mobile banking platforms now provide access to financial services for populations previously excluded from the formal banking system. This shift represents more than just technological advancement—it’s a fundamental reimagining of how financial services can reach every corner of the globe.

Anúncios

According to recent statistics, over 1.7 billion adults worldwide remain unbanked, lacking access to even the most basic financial services. However, mobile phone penetration has reached unprecedented levels, with more than 5 billion unique mobile subscribers globally. This gap between mobile access and banking access presents both a challenge and an extraordinary opportunity for financial inclusion.

Mobile banking applications have emerged as the bridge connecting these two realities, offering a pathway to financial freedom for individuals who have been historically marginalized by traditional banking systems. From rural farmers in Kenya to street vendors in India, mobile banking is democratizing access to financial tools that were once available only to the privileged few.

Anúncios

Breaking Down Barriers: How Mobile Banking Enables Access

Traditional banking systems have long imposed barriers that exclude significant portions of the global population. Minimum balance requirements, identification documentation, physical proximity to branches, and complex application processes have kept millions locked out of the formal financial system. Mobile banking dismantles these obstacles in several transformative ways.

Geographic Accessibility Without Boundaries 🌍

One of the most powerful aspects of mobile banking is its ability to transcend geographic limitations. In remote villages where the nearest bank branch might be hours away by foot, a mobile phone becomes a complete banking solution. Users can check balances, transfer money, pay bills, and access credit without ever traveling to a physical location.

This geographic freedom is particularly transformative in developing regions where infrastructure development has not kept pace with population growth. Mobile banking leapfrogs the need for expensive brick-and-mortar expansion, bringing financial services directly to people’s pockets regardless of their location.

Lower Entry Barriers and Reduced Costs

Mobile banking platforms typically require minimal documentation and no minimum balance requirements, making them accessible to low-income populations. The cost structure also favors financial inclusion—transaction fees are significantly lower than traditional banking, and many basic services are provided free of charge.

This cost efficiency benefits both users and service providers. Financial institutions save on operational expenses associated with physical branches, while customers enjoy affordable access to essential banking services. This win-win scenario has accelerated the adoption of mobile banking across diverse economic segments.

Real-World Impact: Success Stories From Around the Globe

The theoretical benefits of mobile banking for financial inclusion are compelling, but the real-world impact tells an even more powerful story. Across continents, mobile banking initiatives have transformed economies and individual lives in measurable ways.

M-Pesa: The African Mobile Money Pioneer 🦁

Kenya’s M-Pesa stands as perhaps the most celebrated mobile banking success story. Launched in 2007, this mobile money platform now serves over 50 million users across multiple African countries. M-Pesa enabled millions of Kenyans to send and receive money, pay bills, access credit, and save—many for the first time in their lives.

Research has shown that M-Pesa lifted approximately 2% of Kenyan households out of poverty, with particularly significant impacts on female-headed households. The platform demonstrated that mobile banking could serve as a genuine economic development tool, not merely a technological novelty.

Nenhum dado válido encontrado para as URLs fornecidas.

India’s Digital Payment Revolution

India’s Unified Payments Interface (UPI) has created one of the world’s most vibrant digital payment ecosystems. Applications built on this infrastructure have brought hundreds of millions of Indians into the formal financial system. Street vendors, small merchants, and rural populations now participate in the digital economy through simple mobile applications.

The democratization of digital payments in India has had cascading effects on financial inclusion. Once individuals begin using mobile payments, they naturally progress to other financial services—savings accounts, insurance products, and microloans—creating a comprehensive financial ecosystem accessible through a smartphone.

Latin American Financial Innovation

Countries like Brazil, Mexico, and Colombia have witnessed explosive growth in digital banking platforms designed specifically for underserved populations. These neobanks offer full-service banking through mobile applications, targeting individuals who lack access to traditional banks or find their services too expensive or complicated.

The success of these platforms demonstrates that financial inclusion through mobile banking isn’t limited to one region or economic context. The model is adaptable and scalable across diverse cultural and regulatory environments.

Key Features Driving Financial Inclusion Through Mobile Banking

Not all mobile banking platforms contribute equally to financial inclusion. The most successful applications share certain characteristics that make them particularly effective at serving previously unbanked populations.

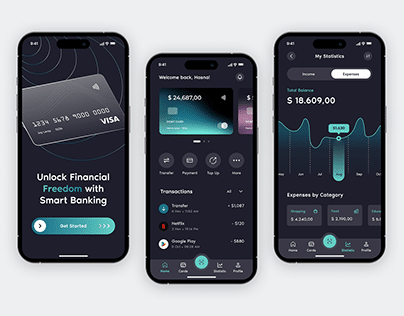

User-Friendly Interface Design 🎨

Financial inclusion requires that applications be usable by individuals with varying levels of digital literacy and education. The best mobile banking platforms employ intuitive design principles, using visual cues, simple language, and straightforward navigation. Many successful applications incorporate local languages and cultural references that resonate with target populations.

Voice-based interfaces and biometric authentication have further reduced barriers for users who may struggle with text-based inputs or complex passwords. These accessibility features transform mobile banking from a tool for the tech-savvy into a universal financial utility.

Micro-Transaction Capabilities

Traditional banking systems often struggle to process small-value transactions profitably. Mobile banking platforms excel at handling micro-transactions efficiently, making them ideal for low-income users whose financial activities involve small, frequent transactions rather than large, occasional ones.

This capability is crucial for financial inclusion because it validates the economic activities of informal sector workers, small-scale farmers, and daily wage earners. When the financial system can accommodate their transaction patterns, these populations gain full access to financial tools.

Integration With Broader Ecosystems

The most transformative mobile banking platforms don’t operate in isolation. They integrate with merchant payment systems, government benefit distribution programs, remittance networks, and microfinance institutions. This ecosystem approach creates multiple touchpoints and use cases, making mobile banking indispensable to daily life.

When users can pay for goods, receive their salaries, send money to family, and access loans all through one mobile platform, the value proposition becomes overwhelming. This comprehensive utility drives adoption and sustained engagement.

Overcoming Challenges on the Path to Inclusion 🚀

Despite tremendous progress, mobile banking still faces significant challenges in fulfilling its potential for universal financial inclusion. Addressing these obstacles requires coordinated efforts from technology providers, financial institutions, regulators, and governments.

Digital Literacy and Trust Building

Many unbanked populations lack not only access to technology but also the knowledge and confidence to use it effectively. Digital literacy programs must accompany mobile banking initiatives, teaching basic smartphone operation, security practices, and financial concepts.

Trust represents an equally significant barrier. Populations that have been excluded from or exploited by financial systems understandably approach new financial technologies with skepticism. Building trust requires time, transparency, consumer protection mechanisms, and visible success stories within communities.

Infrastructure and Connectivity Issues

Mobile banking requires reliable mobile network coverage and internet connectivity. In many regions where financial inclusion is most needed, infrastructure remains inadequate. Intermittent connectivity, slow data speeds, and high data costs limit mobile banking’s effectiveness.

Solutions include developing lightweight applications that function on basic feature phones, enabling offline transaction capabilities, and partnering with telecommunications providers to expand network coverage and reduce data costs for financial services.

Regulatory Frameworks and Consumer Protection

Appropriate regulation balances innovation with consumer protection. Too much regulation stifles innovation and drives up costs, reducing accessibility. Too little regulation exposes vulnerable populations to fraud, data breaches, and predatory practices.

Progressive regulatory frameworks recognize mobile banking’s potential for financial inclusion while establishing guardrails that protect users. Tiered licensing systems, proportionate know-your-customer requirements, and clear consumer recourse mechanisms create environments where mobile banking can thrive responsibly.

The Future Landscape: Emerging Technologies and Opportunities

Mobile banking’s journey toward universal financial inclusion continues to evolve with emerging technologies and innovative approaches that promise to extend reach and deepen impact.

Artificial Intelligence and Personalization 🤖

AI-powered mobile banking platforms can analyze user behavior to offer personalized financial advice, predict cash flow needs, and recommend appropriate financial products. For newly banked populations, this guidance is invaluable, helping them navigate unfamiliar financial decisions and maximize the benefits of financial inclusion.

Machine learning algorithms also enable more sophisticated credit scoring models that consider alternative data sources beyond traditional credit histories. This capability expands access to credit for individuals with limited or no formal credit records, opening new economic opportunities.

Blockchain and Decentralized Finance

Blockchain technology offers potential solutions to several financial inclusion challenges, including reducing remittance costs, enabling transparent record-keeping, and facilitating peer-to-peer lending without traditional intermediaries. As these technologies mature and become more user-friendly, they may integrate with mobile banking platforms to enhance accessibility.

However, the complexity and volatility associated with many blockchain-based financial products require careful consideration. The focus must remain on practical applications that genuinely serve the needs of unbanked populations rather than technological novelty for its own sake.

Super Apps and Financial Services Integration

The super app model—combining multiple services within a single application—is gaining traction as a vehicle for financial inclusion. When banking services integrate with e-commerce, transportation, communication, and entertainment within one app, the barriers to adoption decrease significantly.

Users initially drawn to non-financial features gradually discover and adopt banking functionalities, creating a gentle on-ramp to full financial participation. This model has proven particularly successful in Asian markets and holds promise for other regions.

Building Sustainable Financial Freedom Through Mobile Solutions 💰

True financial inclusion extends beyond basic account access to encompass the full spectrum of financial services that enable economic mobility and resilience. Mobile banking platforms increasingly offer comprehensive solutions that support long-term financial well-being.

Savings and Investment Tools

Mobile banking applications now incorporate features that encourage and facilitate saving behavior. Goal-based savings accounts, automated savings transfers, and micro-investment opportunities help users build financial buffers and accumulate wealth over time.

These features are particularly valuable for populations new to formal financial systems, as they provide structure and motivation for developing healthy financial habits. Visual progress indicators, notifications, and rewards systems leverage behavioral economics principles to promote sustained engagement with savings goals.

Insurance and Risk Management

Mobile-based micro-insurance products protect vulnerable populations from financial shocks that can wipe out years of economic progress. Weather insurance for farmers, health insurance for informal workers, and life insurance for breadwinners become affordable and accessible through mobile platforms.

The ability to purchase insurance with small, frequent premium payments aligns with the cash flow patterns of low-income users. Claims processing through mobile channels reduces friction and accelerates payouts when protection is most needed.

Credit Access and Entrepreneurship Support

Mobile banking platforms increasingly offer microloans and small business financing, enabling entrepreneurship among populations that traditional lenders overlook. Alternative credit assessment methods based on mobile money transaction histories, social connections, and behavioral data expand access to credit for individuals without conventional collateral or credit histories.

This credit access serves as a catalyst for economic mobility, allowing individuals to invest in income-generating activities, smooth consumption during lean periods, and respond to emergencies without resorting to predatory informal lenders.

Creating Lasting Impact: Beyond Technology to Empowerment 🌟

The ultimate measure of mobile banking’s success in promoting financial inclusion isn’t the number of accounts opened or transactions processed—it’s the tangible improvement in people’s lives and economic opportunities. Financial freedom means having the tools and resources to make informed financial decisions, pursue economic aspirations, and withstand financial shocks.

Mobile banking creates this freedom by reducing transaction costs, increasing convenience, improving transparency, and expanding access to a full suite of financial services. When a rural woman can save money securely, receive payments for her products instantly, access credit to expand her business, and insure against crop failure—all through her mobile phone—she gains agency over her economic destiny.

The ripple effects extend beyond individual users to entire communities and economies. Financial inclusion through mobile banking increases economic activity, formalizes informal sectors, improves government revenue collection, and reduces corruption in benefit distribution. These systemic benefits complement individual empowerment to drive broad-based economic development.

As mobile banking technology continues to evolve and expand, maintaining focus on genuine inclusion remains essential. Success requires more than technological capability—it demands understanding diverse user needs, building trust within communities, creating supportive regulatory environments, and measuring impact against real human outcomes rather than vanity metrics.

The power of mobile banking to unlock financial freedom for billions of people represents one of the most significant economic opportunities of our time. By continuing to innovate, collaborate, and center the needs of underserved populations, the financial services industry can transform mobile banking from a convenient tool for the already banked into a fundamental human right accessible to all.

Financial inclusion through mobile banking isn’t just about technology—it’s about dignity, opportunity, and empowerment. It’s about ensuring that everyone, regardless of geography, income, or background, has the financial tools to build the future they envision. That vision is within reach, one mobile transaction at a time.