Anúncios

The financial world stands at a crossroads where traditional sovereign currencies clash with emerging decentralized alternatives, reshaping how we perceive and exchange value globally.

🏦 The Traditional Throne: Understanding Sovereign Currencies

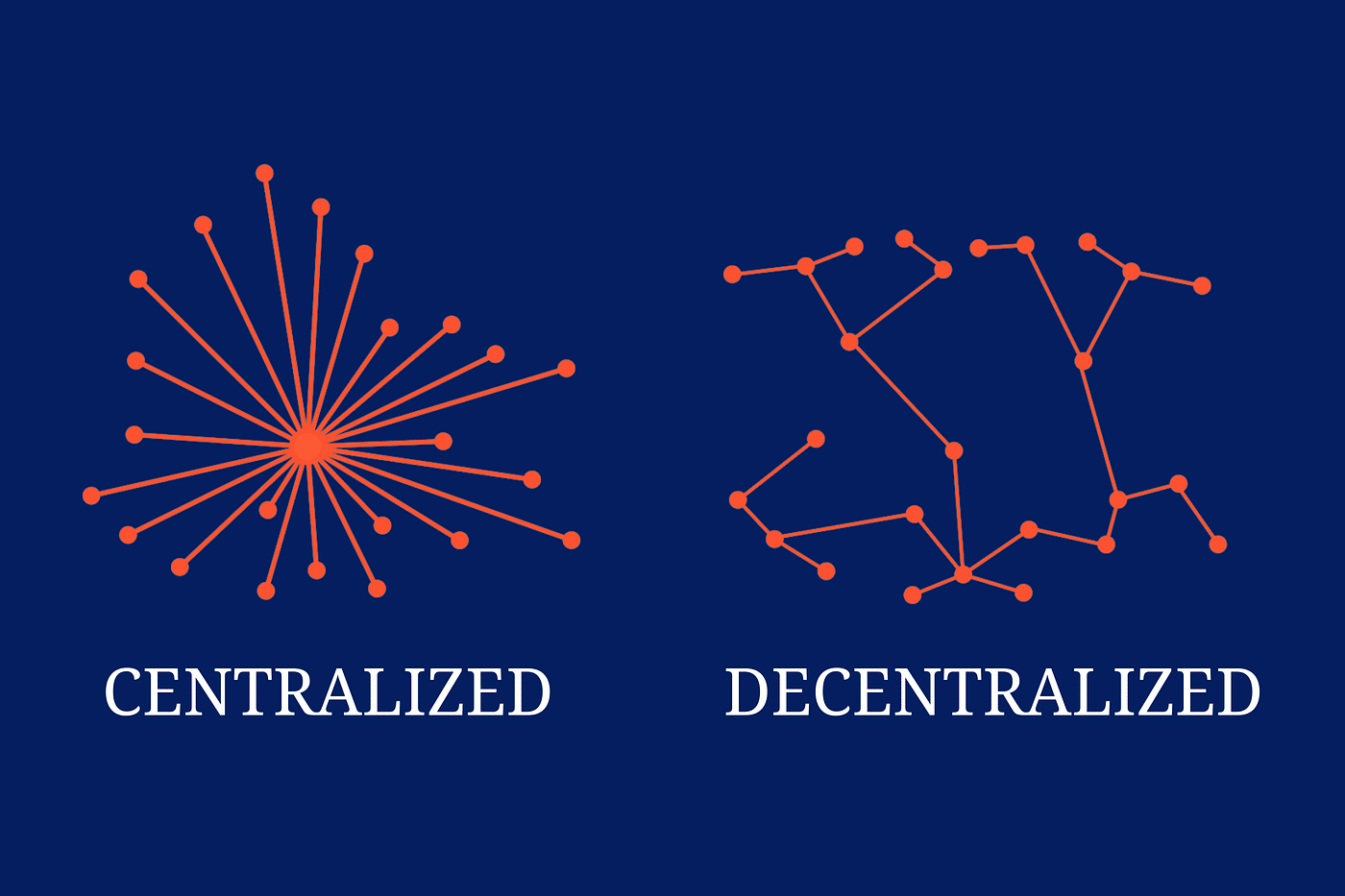

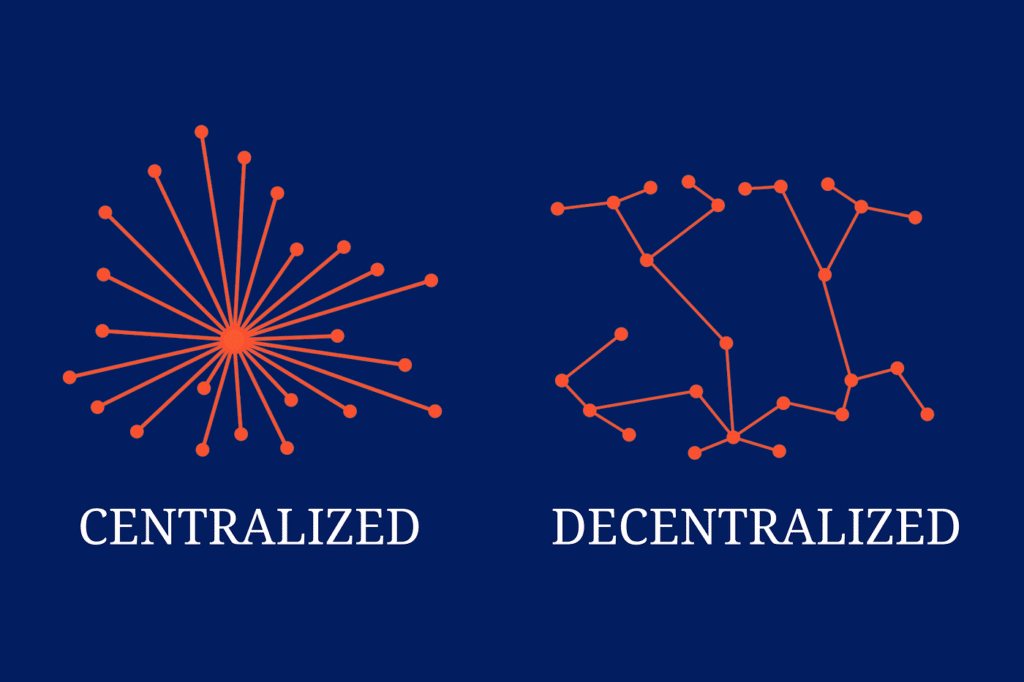

Sovereign currencies have dominated the financial landscape for centuries, serving as the cornerstone of national economies and international trade. These government-issued forms of money represent more than just a medium of exchange—they embody national identity, economic policy, and state power. Central banks worldwide control monetary supply, interest rates, and economic stability through these traditional currencies.

Anúncios

The United States dollar, Euro, British pound, and Japanese yen exemplify sovereign currencies that command respect and widespread acceptance across global markets. These fiat currencies derive their value from government decree and the trust citizens place in their issuing authorities. The centralized nature of sovereign money enables governments to implement fiscal policies, combat inflation, and respond to economic crises with coordinated interventions.

Traditional banking infrastructure supporting sovereign currencies has evolved over generations, creating sophisticated payment systems, regulatory frameworks, and consumer protections. This established ecosystem provides stability, legal recourse, and insurance mechanisms that protect depositors and maintain public confidence in the financial system.

Anúncios

⚡ The Revolutionary Challenger: Decentralized Currency Explained

Decentralized currencies emerged as a radical alternative to traditional monetary systems, pioneered by Bitcoin’s introduction in 2009. These digital assets operate on blockchain technology, eliminating the need for central authorities or intermediaries. Instead, distributed networks of computers validate transactions through cryptographic consensus mechanisms, creating transparent and immutable records.

Cryptocurrencies like Bitcoin, Ethereum, and thousands of alternative coins represent this new paradigm. Unlike sovereign currencies, no single entity controls their issuance or management. Mathematical algorithms govern supply, while peer-to-peer networks facilitate transactions without requiring permission from banks or governments. This fundamental shift challenges centuries-old assumptions about who should control money and how financial systems should operate.

The decentralized approach promises financial inclusion for unbanked populations, reduced transaction costs, faster cross-border payments, and protection against government manipulation or currency devaluation. Proponents argue that removing centralized control creates fairer, more accessible financial systems that empower individuals rather than institutions.

💪 Strengths of Sovereign Currency Systems

Government-backed currencies possess distinct advantages that have sustained their dominance throughout modern history. The most significant strength lies in their legal tender status, which compels acceptance within national borders and provides certainty for contractual obligations. This universal acceptance eliminates the friction that alternative currencies face in everyday transactions.

Monetary policy flexibility represents another crucial advantage. Central banks can adjust interest rates, implement quantitative easing, or tighten money supply to address economic challenges. During the 2008 financial crisis and the 2020 pandemic, governments deployed unprecedented monetary interventions to stabilize economies—actions impossible with algorithmically-constrained decentralized currencies.

Consumer protections embedded in traditional banking systems offer security that decentralized alternatives struggle to match. Deposit insurance schemes, fraud prevention mechanisms, transaction reversibility, and regulatory oversight provide safety nets that protect citizens from losses. When banks fail or fraud occurs, established legal frameworks offer recourse and compensation.

Price stability distinguishes major sovereign currencies from volatile cryptocurrencies. While some nations experience hyperinflation, reserve currencies like the dollar maintain relatively predictable value, enabling long-term planning for businesses and individuals. This stability facilitates lending, investment, and economic growth in ways that volatile digital assets cannot currently support.

🚀 The Compelling Case for Decentralized Currencies

Decentralized currencies address fundamental weaknesses in traditional monetary systems, offering compelling benefits that attract growing adoption. The elimination of intermediaries dramatically reduces transaction costs, particularly for international transfers. Cross-border payments that traditionally take days and incur substantial fees can occur within minutes at minimal cost on blockchain networks.

Financial sovereignty represents a core philosophical advantage. Users maintain complete control over their assets without relying on banks that can freeze accounts, impose restrictions, or fail during crises. Private keys replace institutional permission, putting individuals in charge of their financial destinies. This autonomy particularly appeals to populations in countries with unstable currencies or authoritarian governments.

Transparency and auditability distinguish blockchain-based systems from opaque traditional banking. Every transaction exists on public ledgers, creating unprecedented accountability and reducing opportunities for corruption. While privacy concerns arise, the fundamental transparency of decentralized networks prevents the hidden manipulation possible in centralized systems.

Programmability introduces revolutionary possibilities beyond simple value transfer. Smart contracts on platforms like Ethereum enable automated agreements, decentralized applications, and complex financial instruments without intermediaries. This programmable money creates entirely new economic possibilities that sovereign currencies cannot replicate within their traditional frameworks.

⚠️ Critical Vulnerabilities in Traditional Systems

Sovereign currencies face significant challenges that decentralized alternatives aim to address. Inflation erodes purchasing power over time, with central banks deliberately targeting annual inflation rates that gradually diminish savings. While moderate inflation encourages spending and investment, it represents a hidden tax that particularly impacts those unable to invest in inflation-resistant assets.

Government overreach and monetary manipulation pose risks that history repeatedly demonstrates. From Zimbabwe’s hyperinflation to Venezuela’s currency collapse, centralized control creates opportunities for catastrophic mismanagement. Even stable democracies face temptations to print money for political purposes, creating long-term economic consequences for short-term political gains.

Banking system fragility periodically threatens economic stability. The 2008 financial crisis revealed how interconnected banking networks can amplify risks, requiring massive government bailouts to prevent total collapse. Fractional reserve banking means that banks don’t actually hold all deposited funds, creating inherent vulnerability during panic withdrawals.

Financial exclusion affects billions globally who lack access to traditional banking services. Opening accounts requires documentation, minimum balances, and infrastructure that exclude poor or marginalized populations. Geographic limitations, discriminatory practices, and bureaucratic barriers prevent many from participating in formal financial systems that sovereign currencies require.

🔍 The Dark Side of Decentralization

Despite their promise, decentralized currencies carry serious drawbacks that limit mainstream adoption and raise legitimate concerns. Extreme price volatility makes cryptocurrencies unsuitable as everyday currencies or reliable stores of value. Bitcoin’s price fluctuations of 20% or more within days create uncertainty incompatible with stable economic planning, salary payments, or predictable pricing.

Irreversible transactions eliminate consumer protections that traditional systems provide. Sending cryptocurrency to wrong addresses, falling victim to scams, or experiencing technical errors results in permanent loss with no recourse. The “be your own bank” philosophy places enormous responsibility on users, and mistakes prove unforgiving in ways that conventional banking prevents.

Scalability limitations constrain blockchain networks during high usage periods. Bitcoin processes roughly seven transactions per second compared to Visa’s thousands per second. Network congestion increases fees and slows confirmations, undermining the efficiency advantages that cryptocurrency proponents tout. While second-layer solutions and alternative blockchains address this issue, no decentralized network currently matches traditional payment infrastructure capacity.

Environmental concerns surround proof-of-work cryptocurrencies like Bitcoin, which consume enormous amounts of electricity for mining operations. The carbon footprint rivals that of entire countries, raising questions about sustainability. While newer consensus mechanisms reduce energy consumption, the environmental cost of major cryptocurrencies remains controversial.

Regulatory uncertainty creates legal risks for cryptocurrency users and businesses. Governments worldwide struggle to classify, tax, and regulate digital assets, creating confusion and potential legal liability. The anonymous nature of cryptocurrencies facilitates money laundering, tax evasion, and criminal activities, prompting aggressive regulatory responses that threaten decentralized currency ecosystems.

📊 Comparing Performance Across Key Metrics

| Feature | Sovereign Currencies | Decentralized Currencies |

|---|---|---|

| Price Stability | High (major currencies) | Low (highly volatile) |

| Transaction Speed | Instant to days | Minutes to hours |

| Transaction Costs | Moderate to high (international) | Low to high (network dependent) |

| Regulatory Protection | Strong | Minimal |

| Accessibility | Requires banking infrastructure | Requires internet and technology |

| Privacy | Limited | Variable (pseudonymous) |

| Control | Centralized authorities | Individual users |

🌍 Real-World Applications and Adoption Patterns

Both currency types demonstrate distinct use cases where their characteristics provide optimal solutions. Sovereign currencies dominate everyday commerce, salary payments, taxation, and large-scale economic activity. Businesses maintain accounting in national currencies, governments collect taxes exclusively in fiat money, and most citizens conduct daily transactions without considering alternatives. This entrenchment creates powerful network effects that resist disruption.

Decentralized currencies have carved niches where traditional systems prove inadequate. International remittances represent a killer application, with migrants sending money home at a fraction of traditional wire transfer costs. Countries experiencing currency instability see increased cryptocurrency adoption as citizens seek stores of value outside government control. El Salvador’s recognition of Bitcoin as legal tender represents the most ambitious national experiment with cryptocurrency integration.

Investment and speculation currently drive most cryptocurrency activity. Digital assets function more as commodities or securities than currencies, with investors betting on future value appreciation rather than using them for transactions. This speculative nature contributes to volatility while building infrastructure and awareness that may enable future currency functions.

Institutional adoption signals maturation in decentralized currency markets. Major corporations now hold Bitcoin on balance sheets, traditional financial institutions offer cryptocurrency services, and regulated futures markets provide institutional access. This legitimization bridges sovereign and decentralized systems, creating hybrid approaches that leverage strengths of both paradigms.

🔮 The Emerging Hybrid Future

Rather than complete victory for either approach, the financial landscape increasingly embraces hybrid models combining centralized and decentralized elements. Central Bank Digital Currencies (CBDCs) represent government attempts to capture blockchain benefits within sovereign frameworks. China’s digital yuan, the European Central Bank’s digital euro project, and dozens of similar initiatives worldwide demonstrate that central banks recognize decentralized technology’s advantages.

CBDCs promise faster payments, reduced costs, and improved financial inclusion while maintaining government control and regulatory oversight. These digital sovereign currencies could modernize monetary policy implementation, combat money laundering, and extend financial services to underserved populations. However, they also raise surveillance concerns and potentially increase government control over citizen finances.

Stablecoins emerge as another hybrid solution, combining cryptocurrency infrastructure with price stability by pegging value to sovereign currencies or commodities. Tether, USD Coin, and similar projects attempt to provide digital asset benefits without extreme volatility. These bridges between traditional and decentralized finance enable easier movement between systems while providing more practical transaction currencies.

Decentralized finance (DeFi) platforms recreate traditional banking services—lending, borrowing, trading—using blockchain technology and smart contracts. These systems operate without central authorities while providing financial services previously requiring institutional intermediaries. DeFi represents a middle ground where decentralized technology delivers traditional financial functions in revolutionary ways.

💡 Navigating the Currency Revolution

The sovereignty versus decentralization debate presents false dichotomy. Both currency types will likely coexist, serving different needs within an increasingly complex financial ecosystem. Sovereign currencies provide stability, legal frameworks, and institutional backing essential for large-scale economic activity. Decentralized currencies offer innovation, efficiency, and alternatives where traditional systems fail or exclude participants.

Individuals should understand both paradigms rather than choosing absolute allegiance to either. Diversification across currency types—holding some sovereign currency for stability and daily transactions while exploring decentralized alternatives for specific use cases—represents prudent strategy. Financial literacy must expand to encompass both traditional banking and cryptocurrency fundamentals as these systems increasingly interact.

Governments face critical decisions about regulating decentralized currencies without stifling innovation or driving activity underground. Heavy-handed prohibition proves ineffective given blockchain’s borderless nature, while complete regulatory absence enables fraud and criminal activity. Balanced approaches recognizing legitimate uses while preventing abuse will determine how successfully nations integrate cryptocurrency innovation into existing financial systems.

🎯 The Verdict: Complementary Forces Rather Than Competitors

No single currency type reigns supreme across all contexts and applications. Sovereign currencies dominate due to legal mandates, established infrastructure, price stability, and institutional backing that decentralized alternatives cannot currently match. For everyday transactions, business operations, and large-scale economic activity, government-backed money maintains overwhelming advantages.

However, decentralized currencies address real shortcomings in traditional systems and provide valuable alternatives in specific contexts. Cross-border transactions, financial inclusion, protection against government overreach, and technological innovation flourish in decentralized ecosystems. As blockchain technology matures and cryptocurrencies stabilize, their utility will expand beyond current niche applications.

The financial landscape evolves toward pluralism where multiple currency types coexist and interact. Traditional banking will adopt blockchain efficiencies, cryptocurrencies will develop stability mechanisms, and hybrid models will bridge both worlds. Rather than crowning a single victor, the currency showdown produces a richer, more diverse financial ecosystem offering greater choice and innovation than either approach alone could provide.

Citizens, businesses, and governments must adapt to this multi-currency reality, developing literacy across both paradigms and building systems that interoperate across traditional and decentralized platforms. The future belongs not to sovereign or decentralized currencies exclusively, but to those who skillfully navigate both, leveraging each system’s strengths while mitigating weaknesses through thoughtful integration and balanced adoption.