Anúncios

Investment funds are evolving beyond traditional financial metrics, embracing impact measurement and sustainability as core indicators of long-term success and stakeholder value creation.

🌍 The Evolution of Success Measurement in Modern Investment

The landscape of investment fund management has undergone a remarkable transformation over the past decade. Where returns on investment once stood as the solitary benchmark of success, today’s investors demand a more comprehensive understanding of how their capital creates value. This shift reflects a fundamental recognition that financial performance alone cannot capture the full picture of an investment’s impact on society, the environment, and long-term economic stability.

Anúncios

Traditional metrics such as Internal Rate of Return (IRR), Net Present Value (NPV), and Return on Investment (ROI) remain important, but they now share the stage with environmental, social, and governance (ESG) indicators. This evolution isn’t merely a trend—it represents a structural change in how we define and measure value creation in the 21st century.

Investment fund managers now face the complex challenge of balancing financial objectives with measurable impact outcomes. This dual mandate requires sophisticated frameworks that can quantify both monetary returns and broader societal benefits, creating a more holistic assessment of investment success.

Anúncios

📊 Core Financial Metrics: The Foundation Still Matters

Despite the growing emphasis on impact metrics, traditional financial indicators remain the bedrock of investment fund evaluation. These quantitative measures provide essential insights into fund performance and remain critical for investor decision-making and regulatory compliance.

Essential Performance Indicators

Return on investment continues to serve as the primary metric for assessing financial success. Fund managers track various return measures including absolute returns, risk-adjusted returns, and benchmark-relative performance. The Sharpe ratio, which measures excess return per unit of risk, provides investors with crucial context about whether higher returns justify the associated volatility.

Alpha generation—the ability to outperform market benchmarks—remains a key differentiator among investment funds. Managers who consistently deliver positive alpha demonstrate skill in security selection and market timing, justifying their management fees and attracting institutional capital.

Portfolio volatility and maximum drawdown metrics help investors understand the risk profile of their investments. These measures prove particularly valuable during market downturns, when understanding downside protection becomes paramount to preserving capital.

Liquidity and Operational Metrics

Beyond returns, operational efficiency metrics provide insight into fund management quality. Expense ratios, turnover rates, and asset flows indicate how effectively managers deploy capital and control costs. Lower expense ratios directly enhance net returns to investors, while excessive turnover may signal undisciplined trading or strategy drift.

Assets under management (AUM) growth serves as both a performance indicator and a business metric. Steady AUM expansion suggests investor confidence, though rapid growth can sometimes strain a fund’s ability to maintain its investment edge, particularly in less liquid market segments.

🌱 Impact Metrics: Measuring What Matters Beyond Returns

The integration of impact metrics represents one of the most significant developments in investment fund management. These measurements attempt to quantify the real-world effects of investment decisions on environmental sustainability, social equity, and governance standards.

Environmental Impact Indicators

Carbon footprint measurement has become a standard practice for sustainability-focused funds. Investors increasingly demand transparency regarding the greenhouse gas emissions associated with their portfolio companies. Funds track both direct emissions (Scope 1) and indirect emissions from purchased energy (Scope 2), with leading managers also measuring value chain emissions (Scope 3).

Resource efficiency metrics assess how portfolio companies manage water usage, waste production, and energy consumption. These indicators not only reflect environmental stewardship but often correlate with operational efficiency and long-term cost savings.

Renewable energy adoption rates within portfolio companies provide another tangible measure of environmental progress. Funds can track the percentage of energy derived from renewable sources and the capital allocated to clean energy infrastructure.

Social Impact Measurements

Social metrics capture an investment’s effect on human welfare and community development. Job creation figures, wage levels relative to living wages, and workforce diversity statistics offer quantifiable insights into social value creation.

Access and inclusion metrics measure how portfolio companies serve underserved populations or expand access to essential services. For funds focused on financial inclusion, metrics might track the number of previously unbanked individuals gaining access to financial services.

Community investment indicators assess how companies engage with and benefit local communities. This might include local hiring percentages, procurement from local suppliers, or contributions to community development programs.

Governance and Ethics Standards

Governance metrics evaluate the quality of corporate oversight and decision-making structures. Board composition, including diversity and independence metrics, provides insight into governance quality. Executive compensation ratios, comparing CEO pay to median worker compensation, offer a window into corporate culture and equity considerations.

Transparency and disclosure practices serve as crucial governance indicators. Funds can assess portfolio companies based on their ESG reporting standards, third-party audits, and stakeholder engagement practices.

🎯 Frameworks for Integrated Impact Assessment

Several standardized frameworks have emerged to help investment funds measure and report on sustainability and impact metrics consistently and credibly.

The Global Reporting Initiative (GRI)

The GRI Standards provide a comprehensive framework for sustainability reporting, covering economic, environmental, and social dimensions. Investment funds can use GRI guidelines to structure their impact reporting and ensure comparability with global peers.

Sustainable Development Goals (SDGs) Alignment

Many impact-focused funds now map their investments to the United Nations’ 17 Sustainable Development Goals. This alignment provides a common language for discussing impact and allows investors to direct capital toward specific global challenges, from poverty reduction to climate action.

Funds can report which SDGs their portfolio companies contribute to and quantify that contribution through specific metrics aligned with each goal. For example, investments in clean energy companies would track progress toward SDG 7 (Affordable and Clean Energy) through metrics like megawatts of renewable capacity added or households served.

IRIS+ and Impact Management Project

The Impact Management Project’s five dimensions of impact—what, who, how much, contribution, and risk—provide a structured approach to assessing impact investments. Combined with the IRIS+ metrics catalog, this framework enables rigorous, standardized impact measurement across diverse investment strategies.

⚖️ Balancing Financial Returns with Impact Objectives

One of the persistent debates in sustainable investing centers on whether impact objectives necessitate financial trade-offs. Emerging evidence suggests that well-managed sustainable investments can achieve competitive returns while generating measurable positive impact.

The Risk-Return-Impact Triangle

Modern portfolio theory traditionally considered only risk and return, but impact investing adds a third dimension. Fund managers must now optimize across all three variables, recognizing that impact creation itself can reduce certain long-term risks.

Companies with strong ESG practices often demonstrate greater resilience during market disruptions. Environmental violations, governance scandals, or social controversies can destroy shareholder value rapidly, making robust impact metrics a form of risk management.

Materiality and Financial Performance

The concept of materiality—which ESG factors significantly affect financial performance—helps investors focus on impact metrics that matter most for value creation. Materiality varies by industry; carbon emissions are highly material for energy companies but less so for software firms, while data privacy and security prove material for technology companies.

The Sustainability Accounting Standards Board (SASB) provides industry-specific materiality maps, helping funds identify which sustainability metrics most strongly correlate with financial performance in different sectors.

📈 Technology and Data Infrastructure for Impact Measurement

Effective impact measurement requires robust data collection, analysis, and reporting systems. Technology plays an increasingly critical role in enabling funds to track, verify, and communicate their impact metrics.

Data Collection and Verification

Investment funds must establish systematic processes for gathering impact data from portfolio companies. This often requires integrating ESG data requests into standard reporting requirements and due diligence processes.

Third-party data providers now offer ESG ratings and analytics that complement company-reported data. These services help funds benchmark portfolio companies against peers and identify potential ESG risks that might not be apparent from financial statements alone.

Blockchain and Impact Tracking

Emerging technologies like blockchain offer promising solutions for impact verification. Distributed ledger systems can create immutable records of sustainability metrics, enhancing transparency and reducing the risk of greenwashing.

Smart contracts can automate certain impact measurements and even tie performance fees to achieving specific sustainability milestones, aligning incentives between fund managers and impact objectives.

🔍 Challenges in Impact Measurement and Reporting

Despite significant progress, measuring and reporting impact remains fraught with challenges that can undermine credibility and comparability.

Standardization and Comparability

The proliferation of different frameworks and metrics makes it difficult for investors to compare impact performance across funds. While standardization efforts are underway, the field lacks the universal acceptance that financial accounting standards enjoy.

Different funds may use different methodologies to measure the same impact, such as carbon footprint calculations. These methodological variations can produce dramatically different results, complicating investor decision-making.

Attribution and Additionality

Determining what impact can be genuinely attributed to an investment remains conceptually challenging. Would positive outcomes have occurred without the investment? This question of additionality proves difficult to answer definitively, particularly for publicly traded securities where individual investors represent a small portion of capital.

Impact investors must grapple with counterfactual analysis—what would have happened in the absence of their investment—which requires assumptions that can rarely be validated with certainty.

Short-term Measurement of Long-term Impact

Many sustainability impacts materialize over extended timeframes that exceed typical reporting periods. Climate change mitigation efforts, for instance, deliver benefits over decades, yet funds must report quarterly or annually. This temporal mismatch can incentivize focus on easily measurable short-term metrics rather than more significant long-term impacts.

💡 Best Practices for Investment Fund Impact Reporting

Leading investment funds have developed sophisticated approaches to impact measurement and reporting that balance rigor with practicality.

Transparency and Honesty

The most credible impact reports acknowledge limitations and challenges alongside successes. Transparent reporting about methodology, data quality issues, and areas where impact fell short of expectations builds investor trust more effectively than overly optimistic narratives.

Funds should clearly distinguish between outputs (activities undertaken) and outcomes (actual changes resulting from those activities). Reporting that investment capital flowed to renewable energy companies represents an output; demonstrating reduced emissions or increased clean energy capacity represents an outcome.

Stakeholder Engagement

Effective impact measurement involves dialogue with multiple stakeholders, including investors, portfolio companies, beneficiary communities, and subject matter experts. This engagement helps ensure metrics capture what matters most and that reporting addresses stakeholder information needs.

Regular stakeholder feedback can identify blind spots in impact measurement approaches and highlight unintended consequences that warrant monitoring.

Continuous Improvement

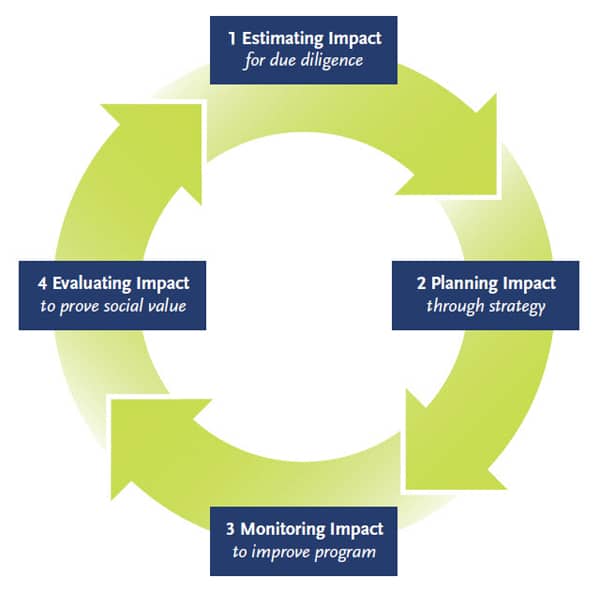

Impact measurement methodologies should evolve as best practices develop and new data becomes available. Leading funds treat impact reporting as an iterative process, regularly refining their approaches based on lessons learned and stakeholder input.

🚀 The Future of Impact Metrics in Investment Management

The trajectory of impact measurement points toward greater integration with mainstream investment practices, enhanced standardization, and increased regulatory requirements.

Regulatory Developments

Regulators worldwide are implementing disclosure requirements that will make impact reporting mandatory rather than voluntary. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) and similar initiatives in other jurisdictions will standardize certain aspects of ESG reporting.

These regulatory frameworks will likely accelerate the development of common metrics and reduce the current fragmentation in sustainability reporting approaches.

Integration with Financial Analysis

The artificial separation between financial and impact analysis will continue to diminish. Forward-thinking fund managers already integrate ESG factors into fundamental analysis, recognizing that sustainability metrics provide valuable insights into operational efficiency, innovation capacity, and risk management.

Investment professionals of the future will need fluency in both financial modeling and impact assessment, viewing these as complementary rather than competing skill sets.

Investor Demand and Capital Flows

Growing investor demand for sustainable investment options will continue driving innovation in impact measurement. As capital flows increasingly toward funds with credible impact credentials, competitive pressure will motivate all fund managers to strengthen their sustainability practices and reporting.

Younger investors, in particular, demonstrate strong preferences for investments aligned with their values, suggesting that impact metrics will only grow in importance as generational wealth transfer accelerates.

🎓 Building Organizational Capacity for Impact Measurement

Successfully implementing comprehensive impact measurement requires more than selecting the right metrics—it demands organizational commitment and capability building.

Fund managers must invest in team training to ensure investment professionals understand sustainability concepts and can critically evaluate impact data. This may involve hiring specialists with expertise in environmental science, social policy, or sustainability reporting to complement traditional financial analysts.

Creating a culture that values impact alongside returns requires leadership commitment and appropriate incentive structures. Some funds now incorporate ESG performance metrics into compensation frameworks, ensuring that portfolio managers have personal stakes in achieving impact objectives.

Technology infrastructure investments enable efficient data collection and analysis. Portfolio management systems should integrate impact metrics alongside financial metrics, allowing portfolio managers to monitor both dimensions in real-time.

🌟 Creating Value Through Measured Impact

The evolution toward comprehensive impact measurement represents more than a reporting exercise—it reflects a fundamental shift in how investment funds create and demonstrate value. Financial returns remain essential, but they now exist within a broader framework that recognizes investments’ effects on environmental sustainability, social equity, and long-term economic stability.

Funds that embrace rigorous impact measurement position themselves advantageously as regulatory requirements tighten and investor expectations evolve. More importantly, they contribute to directing capital toward enterprises that address pressing global challenges while delivering competitive returns.

The measurement challenges are real and ongoing, but the direction is clear. Success in investment fund management increasingly means demonstrating excellence across multiple dimensions—financial performance, environmental stewardship, social contribution, and governance quality. Those who master the art and science of integrated impact measurement will define the next generation of investment excellence.

As frameworks mature, data quality improves, and best practices emerge, impact measurement will become as standardized and credible as financial reporting. This evolution promises to enhance capital allocation efficiency, directing resources toward their highest and best uses not just financially, but holistically—considering all the ways investments shape our world and future.