Anúncios

The global shift toward sustainable investing is accelerating, with transition bonds and green loans emerging as pivotal financial instruments driving environmental progress.

As climate change concerns intensify and regulatory frameworks tighten, investors, corporations, and financial institutions are increasingly recognizing the strategic importance of sustainable finance. The traditional dichotomy between financial returns and environmental responsibility is dissolving, replaced by a more nuanced understanding that long-term profitability depends on ecological sustainability. This paradigm shift has catalyzed innovative financial mechanisms designed to fund the transition toward a low-carbon economy while generating competitive returns.

Anúncios

Transition bonds and green loans represent two complementary approaches to sustainable financing, each offering distinct advantages for different stages of corporate environmental transformation. While green loans have established themselves as reliable instruments for funding explicitly environmental projects, transition bonds address a critical gap: financing companies in carbon-intensive industries as they undertake the challenging journey toward sustainability. Together, these instruments form a comprehensive toolkit for investors committed to supporting genuine environmental progress.

🌱 Understanding the Fundamentals of Sustainable Finance Instruments

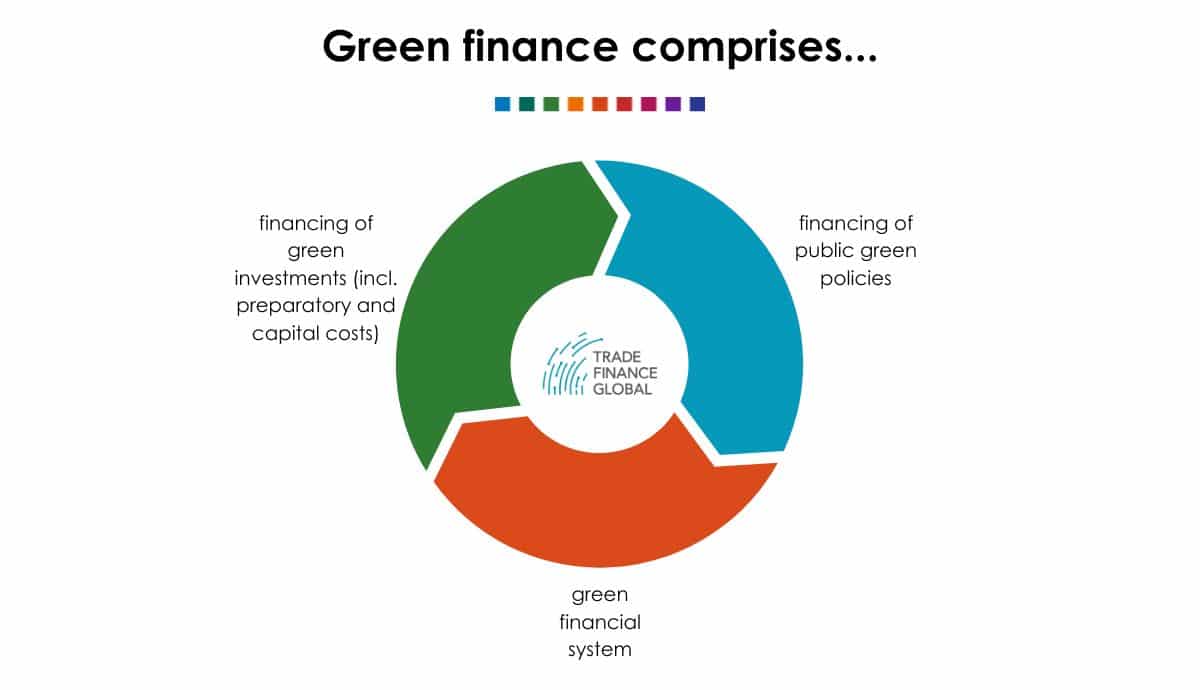

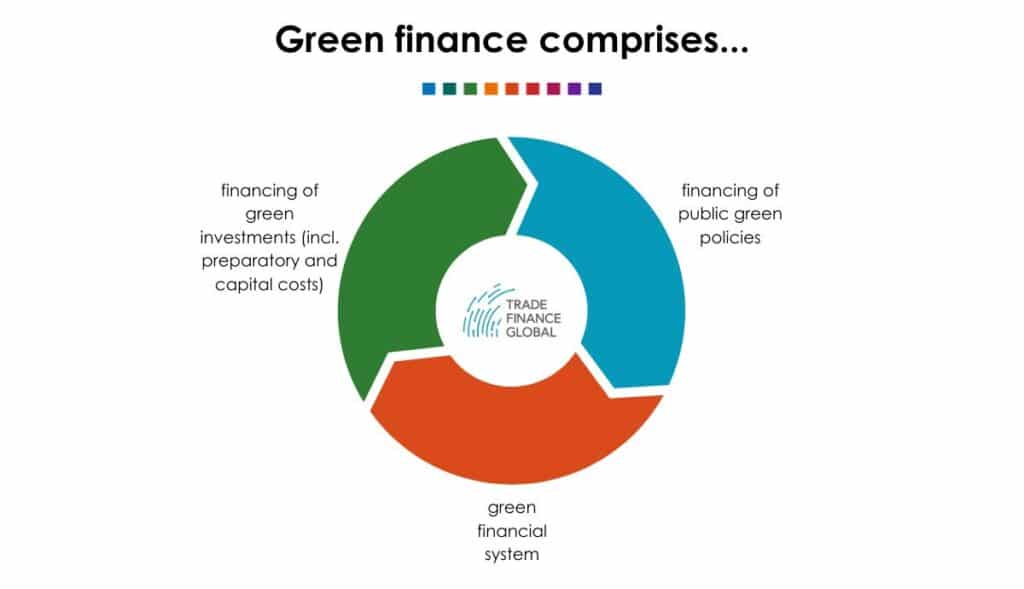

The sustainable finance landscape has evolved significantly over the past decade, moving beyond niche products to become mainstream investment options. Green loans and transition bonds occupy essential positions within this ecosystem, each serving specific purposes while contributing to broader climate objectives.

Anúncios

Green loans are debt instruments specifically earmarked for projects with environmental benefits. These loans fund initiatives such as renewable energy installations, energy efficiency improvements, sustainable water management systems, and green building construction. The defining characteristic of green loans is their use-of-proceeds requirement: borrowed funds must be allocated exclusively to projects that meet established environmental criteria, typically aligned with internationally recognized frameworks like the Green Loan Principles.

Transition bonds, meanwhile, represent a more recent innovation addressing a practical challenge in sustainable finance. These instruments provide capital to companies in traditionally carbon-intensive sectors—such as steel production, cement manufacturing, aviation, and shipping—as they implement credible strategies to reduce their environmental impact. Unlike green bonds that fund inherently “green” projects, transition bonds acknowledge that some industries cannot instantly transform but require substantial investment to gradually achieve sustainability targets.

💼 The Strategic Advantages of Green Loans for Corporate Sustainability

Green loans offer numerous benefits that extend beyond simple environmental compliance, providing strategic advantages for forward-thinking organizations committed to sustainable operations.

Financial Flexibility and Competitive Pricing

One significant advantage of green loans is the potential for favorable pricing terms. Many financial institutions offer interest rate discounts or preferential conditions for qualifying green projects, recognizing the reduced long-term risks associated with environmentally sustainable operations. This pricing advantage can improve project economics and enhance overall return on investment, making sustainability initiatives more financially attractive.

Additionally, green loans typically provide greater flexibility in structuring compared to bond issuances. Borrowers can negotiate customized terms, covenants, and repayment schedules that align with specific project timelines and cash flow projections. This adaptability proves particularly valuable for mid-sized companies or projects with unique characteristics that don’t fit standardized bond structures.

Enhanced Corporate Reputation and Stakeholder Relations

Securing green loan financing signals a company’s genuine commitment to environmental stewardship, strengthening relationships with increasingly sustainability-conscious stakeholders. Customers, employees, investors, and community members all respond positively to demonstrable environmental action, translating to enhanced brand value and competitive differentiation.

Furthermore, companies utilizing green loans position themselves favorably within evolving regulatory environments. As governments worldwide implement stricter environmental standards and carbon pricing mechanisms, organizations with established green financing track records enjoy better preparedness and regulatory compliance, reducing future transition risks and costs.

Access to Expanding Capital Pools

The pool of capital dedicated to sustainable investments continues growing exponentially. Institutional investors, pension funds, and asset managers increasingly integrate environmental, social, and governance (ESG) criteria into investment decisions, creating substantial demand for green financial products. Companies offering green loans as investment opportunities can tap into this expanding capital source, potentially accessing better terms and greater liquidity than conventional financing.

🔄 How Transition Bonds Bridge the Gap in Decarbonization

While green financing instruments support already-sustainable activities, transition bonds address the pragmatic reality that some industries face lengthy, capital-intensive paths toward environmental sustainability.

Enabling Realistic Transformation Pathways

Industries such as steel, cement, chemicals, and heavy transportation cannot immediately eliminate their carbon footprint through existing technologies. However, dismissing these sectors from sustainable finance frameworks would be counterproductive, as they represent significant portions of global emissions. Transition bonds provide the necessary capital for these industries to implement intermediate steps—adopting cleaner production methods, improving energy efficiency, and investing in emerging low-carbon technologies—while maintaining economic viability.

These bonds recognize that transformation requires time, capital, and technological development. By establishing credible transition plans with measurable milestones, companies can access funding that supports gradual but meaningful emissions reductions, ultimately contributing more substantially to climate goals than simply divesting from these sectors.

Transparency and Accountability Mechanisms

Transition bonds incorporate rigorous disclosure and monitoring requirements that ensure genuine environmental progress rather than greenwashing. Issuers must publish detailed transition strategies outlining specific targets, timelines, and key performance indicators. Regular reporting obligations hold companies accountable to their commitments, with independent verification often required to maintain investor confidence.

This transparency benefits all stakeholders. Investors gain clarity regarding environmental risks and progress, enabling informed decision-making. Companies receive structured frameworks guiding their transformation efforts. Regulators and civil society can monitor sectoral progress toward climate objectives, ensuring that transition finance supports authentic change rather than prolonging unsustainable practices.

📊 Comparing Green Loans and Transition Bonds: A Practical Framework

Understanding when to utilize green loans versus transition bonds requires careful consideration of organizational circumstances, industry characteristics, and specific project requirements.

| Aspect | Green Loans | Transition Bonds |

|---|---|---|

| Primary Purpose | Finance specific green projects | Fund corporate-wide transformation strategies |

| Suitable Sectors | Renewable energy, sustainable real estate, clean technology | Steel, cement, aviation, shipping, chemicals |

| Environmental Status | Projects with immediate environmental benefits | Companies transitioning from high to lower emissions |

| Flexibility | High – customizable terms and structures | Moderate – standardized bond frameworks |

| Disclosure Requirements | Project-specific reporting | Comprehensive corporate transition strategy |

| Investor Base | Banks, institutional lenders | Bond investors, asset managers, pension funds |

| Typical Size | Smaller to medium scale | Larger capital requirements |

This framework illustrates that green loans and transition bonds serve complementary rather than competing purposes. Organizations might utilize green loans for specific renewable energy installations while issuing transition bonds to finance broader operational transformations. The choice depends on funding requirements, company positioning within sustainability spectrum, and strategic objectives.

🎯 Maximizing Investment Impact Through Strategic Instrument Selection

For investors committed to sustainable outcomes, understanding how to strategically deploy capital across green loans and transition bonds maximizes both financial returns and environmental impact.

Portfolio Diversification Across the Sustainability Spectrum

A sophisticated sustainable investment portfolio incorporates instruments across different stages of environmental maturity. Green loans to established renewable energy projects provide relatively stable, lower-risk returns while supporting proven technologies. Transition bonds to companies undertaking ambitious transformation programs offer potentially higher returns reflecting greater complexity and risk, while addressing emissions sources that represent larger absolute climate impact.

This diversification approach balances financial risk management with comprehensive climate impact, avoiding the limitation of only funding already-green activities while excluding significant emissions sources from sustainable capital access.

Due Diligence and Greenwashing Prevention

The growing popularity of sustainable finance has unfortunately attracted opportunistic greenwashing, where companies exaggerate environmental credentials to access favorable financing terms. Rigorous due diligence becomes essential for investors seeking authentic impact.

For green loans, verification should confirm that funded projects genuinely deliver stated environmental benefits, with clear measurement methodologies and independent validation. For transition bonds, assessment must evaluate whether proposed strategies represent credible pathways to meaningful emissions reductions or merely incremental improvements maintaining fundamentally unsustainable business models.

Key evaluation criteria include:

- Alignment with science-based targets and internationally recognized standards

- Specificity and measurability of environmental objectives

- Independence and credibility of verification processes

- Integration of environmental strategy with core business operations

- Transparency in reporting and willingness to disclose challenges

- Governance structures ensuring accountability for environmental commitments

🌍 Regulatory Developments Shaping Sustainable Finance Markets

The regulatory landscape surrounding green loans and transition bonds continues evolving rapidly, creating both opportunities and challenges for market participants.

The European Union has taken leadership through its Sustainable Finance Action Plan, which includes the EU Taxonomy providing detailed criteria for environmentally sustainable economic activities. This taxonomy directly influences what qualifies for green financing and establishes frameworks for evaluating transition activities. Similar regulatory initiatives are emerging across jurisdictions including the United Kingdom, Singapore, Japan, and increasingly within individual US states.

These regulatory developments bring several implications. Standardization reduces ambiguity and greenwashing risks, building investor confidence and market integrity. However, compliance requirements increase transaction costs and administrative burdens, potentially disadvantaging smaller issuers. The ongoing challenge involves balancing necessary oversight with maintaining market accessibility and innovation.

For investors and companies alike, staying informed about evolving regulations is essential. Anticipating regulatory directions enables proactive positioning, ensuring financing structures remain compliant while capitalizing on supportive policy frameworks.

💡 Practical Implementation: Steps Toward Sustainable Finance Integration

Organizations seeking to leverage green loans or transition bonds should follow systematic approaches maximizing success probability and impact authenticity.

For Companies Seeking Green Loans

Begin by identifying specific projects delivering measurable environmental benefits that align with recognized green loan principles. Develop comprehensive project documentation including environmental impact assessments, technical specifications, and financial projections. Engage early with potential lenders to understand their green lending criteria and documentation requirements.

Establish internal monitoring systems tracking environmental performance indicators throughout project lifecycle. Plan for transparent reporting to lenders and potentially broader stakeholder groups, demonstrating accountability and building credibility for future sustainable financing initiatives.

For Companies Considering Transition Bonds

Develop a comprehensive corporate transition strategy anchored in science-based targets and clear interim milestones. This strategy should address the company’s entire value chain, identifying major emissions sources and outlining credible reduction pathways. Engage stakeholders including investors, employees, customers, and civil society in strategy development, building broad-based support and identifying potential challenges early.

Secure independent expert validation of transition plans before approaching bond markets. Work with experienced advisors familiar with transition bond frameworks to structure offerings meeting investor expectations. Commit to rigorous ongoing disclosure, recognizing that transparency builds trust and distinguishes authentic transition efforts from greenwashing.

For Investors Integrating Sustainable Instruments

Define clear investment criteria specifying what environmental outcomes align with portfolio objectives. Develop or adopt due diligence frameworks appropriate to evaluating both green loans and transition bonds, potentially including specialist expertise or external advisors for technical environmental assessment.

Allocate capital across the sustainability spectrum rather than exclusively to the greenest opportunities, recognizing that transition financing potentially delivers greater absolute emissions reductions. Engage actively with investee companies, using investor influence to encourage ambitious environmental targets and transparent reporting.

🚀 The Future Trajectory of Sustainable Finance Innovation

The sustainable finance market continues evolving rapidly, with several emerging trends likely to shape the future landscape of green loans and transition bonds.

Technology integration is enhancing transparency and efficiency. Blockchain applications enable improved tracking of green loan proceeds, ensuring funds reach intended projects. Artificial intelligence and satellite monitoring provide independent verification of environmental outcomes, reducing reliance on self-reporting and strengthening market integrity.

The scope of transition finance is expanding beyond traditional heavy industries. Financial institutions themselves are beginning to issue transition bonds funding the gradual greening of lending portfolios. Even within already-sustainable sectors, transition approaches are emerging to support continuous improvement toward net-zero targets rather than static green thresholds.

Blended finance structures combining concessional public capital with commercial investment are increasing transition bond viability for companies in developing economies. These structures address the reality that emerging markets face both greater climate vulnerability and more constrained access to sustainable finance, despite contributing significantly to global emissions trajectories.

The integration of social considerations alongside environmental objectives represents another important evolution. Recognizing that climate transition creates both winners and losers, just transition bonds are emerging that explicitly address workforce impacts, community effects, and equitable distribution of transition costs and benefits.

🔑 Key Takeaways for Sustainable Investment Success

Successfully navigating the sustainable finance landscape requires understanding that green loans and transition bonds serve distinct but complementary purposes within comprehensive climate strategies. Green loans excel at financing specific projects with immediate environmental benefits, offering flexibility and competitive terms for qualifying initiatives. Transition bonds address the pragmatic challenge of funding gradual transformation in carbon-intensive industries that cannot instantaneously achieve sustainability but require substantial capital to undertake meaningful progress.

Both instruments demand rigorous evaluation to distinguish authentic environmental action from superficial greenwashing. Investors should diversify across the sustainability spectrum, recognizing that supporting credible transitions in high-emitting sectors potentially delivers greater absolute climate impact than exclusively funding already-green activities. Companies must approach sustainable finance strategically, aligning financing structures with genuine environmental commitments supported by transparent reporting and independent verification.

The regulatory environment continues evolving, bringing greater standardization and oversight that strengthens market integrity while creating compliance considerations. Staying informed about regulatory developments enables proactive positioning and strategic advantage. As sustainable finance markets mature, innovation in structures, technologies, and approaches will create new opportunities for investors and companies committed to environmental progress.

The transition toward a sustainable global economy represents one of the defining challenges and opportunities of our era. Green loans and transition bonds provide essential financial mechanisms supporting this transformation, channeling capital toward environmental solutions while generating competitive returns. By understanding these instruments’ distinct characteristics and strategic applications, investors and companies can contribute meaningfully to climate objectives while building resilient, future-oriented portfolios and operations. The path forward requires both commitment and sophistication, recognizing that effective sustainable finance balances environmental ambition with financial pragmatism, transparency with accessibility, and standardization with innovation. 🌿