Anúncios

Renewable energy asset funds are reshaping global finance by channeling capital into sustainable infrastructure, offering investors stable returns while accelerating the transition to clean energy.

🌍 The Rising Tide of Green Investment Opportunities

The global energy landscape is experiencing a fundamental transformation. As climate change concerns intensify and governments worldwide commit to carbon neutrality goals, renewable energy asset funds have emerged as powerful vehicles for deploying capital into sustainable infrastructure. These specialized investment funds focus on acquiring, developing, and managing portfolios of renewable energy assets such as solar farms, wind parks, hydroelectric facilities, and energy storage systems.

Anúncios

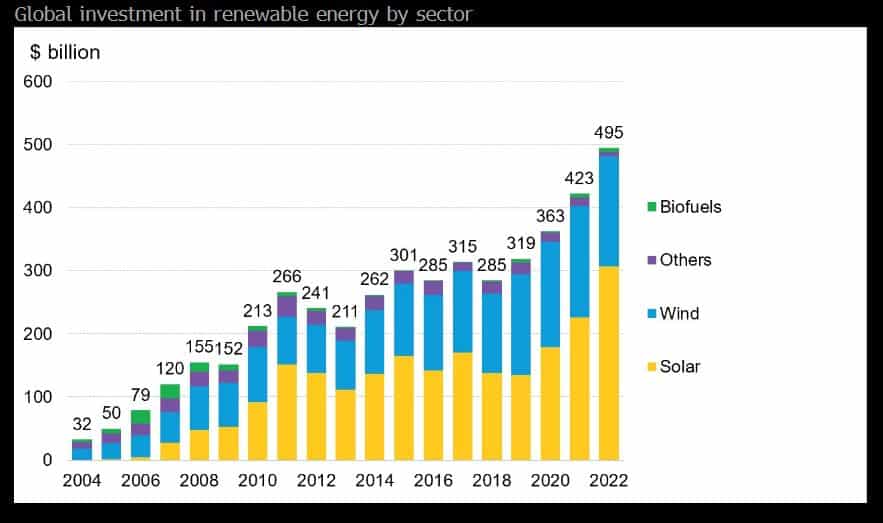

Investment in renewable energy reached unprecedented levels in recent years, with global flows exceeding $500 billion annually. This surge reflects not only environmental consciousness but also the compelling financial performance of clean energy assets. Renewable energy asset funds serve as the critical bridge connecting institutional investors, pension funds, insurance companies, and individual investors with tangible green infrastructure projects that generate predictable cash flows while contributing to decarbonization efforts.

The maturity of renewable technologies has transformed them from speculative ventures into bankable assets with proven track records. Solar and wind energy costs have plummeted by approximately 90% and 70% respectively over the past decade, making these technologies cost-competitive with fossil fuels even without subsidies in many markets. This economic viability has attracted sophisticated financial players who recognize the dual opportunity of generating returns while supporting environmental sustainability.

Anúncios

⚡ Understanding Renewable Energy Asset Fund Structures

Renewable energy asset funds typically operate through several distinct structural models, each designed to meet specific investor needs and risk-return profiles. The most common structure involves closed-end funds that raise capital during a defined period, deploy it into renewable energy projects, and return capital to investors through distributions over the fund’s lifespan, typically ranging from 10 to 25 years.

Infrastructure-style funds focus on acquiring operational assets with established revenue streams, often backed by long-term power purchase agreements (PPAs). These funds prioritize stable cash generation and appeal to conservative investors seeking yield with moderate risk. Development-focused funds, conversely, target projects in earlier stages, accepting higher risk in exchange for potentially greater returns from bringing new capacity online.

Yieldcos represent another popular structure—publicly traded entities that own operating renewable energy assets and distribute most cash flows to shareholders as dividends. These vehicles offer liquidity advantages compared to traditional private funds while providing exposure to renewable energy infrastructure. Hybrid models combining elements of development and operational assets have also gained traction, allowing fund managers to optimize risk-adjusted returns across project lifecycles.

Key Investment Strategies Driving Performance

Successful renewable energy asset funds employ diverse strategies to maximize value creation. Geographic diversification reduces exposure to regional policy changes, weather patterns, and market dynamics. Technology diversification across solar, wind, hydro, and emerging technologies like green hydrogen and battery storage mitigates technology-specific risks while capturing opportunities across the renewable spectrum.

Asset optimization represents another critical strategy. Fund managers increasingly leverage advanced analytics, artificial intelligence, and IoT sensors to enhance operational efficiency, predict maintenance needs, and maximize energy production. These digital capabilities can increase asset performance by 5-15%, directly boosting fund returns.

Value-add strategies focus on acquiring underperforming assets at discounts, implementing operational improvements, and realizing gains through performance enhancement or eventual sale. Repowering older wind farms with modern turbines or adding battery storage to solar facilities exemplifies such approaches, extending asset life and increasing revenue potential.

💰 Financial Performance and Return Characteristics

Renewable energy asset funds have demonstrated compelling financial performance, typically delivering returns in the 6-12% range for operational assets and 12-20% for development-stage investments. These returns stem from multiple sources: energy sales revenue, government incentives, renewable energy certificates, and asset appreciation as clean energy infrastructure becomes increasingly valuable.

The inflation-hedging characteristics of renewable energy investments add particular appeal in current economic environments. Many power purchase agreements include escalation clauses tied to inflation indices, providing natural protection against purchasing power erosion. Additionally, energy prices generally correlate positively with inflation, as do operational and capital costs that can be passed through to buyers.

Volatility profiles distinguish renewable energy assets from traditional equity investments. Operational renewable facilities generate relatively stable cash flows largely independent of economic cycles, resulting in lower volatility comparable to infrastructure and real estate. This stability makes these assets attractive for institutional investors with long-term liabilities, such as pension funds and insurance companies seeking to match assets with future obligations.

Risk Factors Investors Should Consider

Despite attractive characteristics, renewable energy investments carry specific risks requiring careful evaluation. Policy and regulatory risk remains paramount—changes in subsidies, tax incentives, or environmental regulations can materially impact project economics. Investors must assess political stability and commitment to clean energy transition in target markets.

Technology risk encompasses both obsolescence and performance uncertainty. Rapid innovation may render existing technologies less competitive, while operational performance may deviate from projections due to equipment failures or suboptimal weather conditions. Commodity price exposure affects projects selling power into merchant markets without long-term contracts, creating revenue volatility.

Counterparty credit risk emerges when projects depend on power purchase agreements with utilities or corporate buyers. The financial health of these offtakers directly affects cash flow certainty. Construction and development risks affect funds investing in pre-operational projects, including cost overruns, delays, and permitting challenges.

🌱 Environmental Impact Beyond Financial Returns

The primary distinction setting renewable energy asset funds apart from conventional investments lies in their measurable environmental impact. Each megawatt of renewable capacity displaces fossil fuel generation, directly reducing greenhouse gas emissions. Investors can quantify their contribution to climate mitigation through metrics like tons of CO2 avoided or fossil fuel equivalents displaced.

This impact dimension resonates powerfully with investors facing increasing pressure to align portfolios with environmental, social, and governance (ESG) principles. Regulatory developments in Europe, including the Sustainable Finance Disclosure Regulation (SFDR), and similar initiatives globally are compelling institutional investors to demonstrate portfolio sustainability credentials. Renewable energy asset funds offer among the most direct and quantifiable ESG exposures available.

Beyond carbon reduction, renewable energy projects deliver co-benefits including reduced air and water pollution, biodiversity protection through appropriate siting, and community development through local employment and tax revenues. Leading fund managers actively measure and report these broader impacts, recognizing that holistic sustainability performance enhances both social license and long-term value.

📊 Market Dynamics Shaping Industry Growth

Multiple converging trends are propelling renewable energy asset funds into mainstream investment portfolios. Corporate sustainability commitments have exploded, with over 400 companies joining the RE100 initiative pledging 100% renewable electricity. These commitments create substantial demand for renewable energy assets and long-term power purchase agreements, providing revenue visibility that underpins fund performance.

Grid decarbonization targets set by governments worldwide necessitate massive renewable capacity additions. The International Energy Agency projects renewable capacity must triple by 2030 to achieve net-zero emissions by 2050, implying trillions in investment requirements. This demand substantially exceeds available government financing, positioning private capital mobilized through asset funds as essential to meeting climate goals.

Energy storage integration represents a transformative development enhancing renewable asset value. Battery storage systems paired with solar and wind facilities enable energy delivery when needed rather than only when produced, commanding premium pricing and improving project economics. Funds incorporating storage capabilities position themselves advantageously as grid operators increasingly value dispatchable renewable energy.

Geographic Opportunities and Regional Variations

Investment opportunities vary significantly across regions, reflecting differences in resource quality, policy frameworks, and market maturity. North America offers substantial scale, mature regulatory environments, and diverse technology opportunities across solar, wind, and emerging sectors. The Investment Tax Credit and Production Tax Credit in the United States have historically driven significant development, though policy uncertainty remains a consideration.

Europe leads in offshore wind development and provides relatively stable, supportive policy environments through mechanisms like feed-in tariffs and contract-for-difference schemes. The European Green Deal commits massive public and private investment toward carbon neutrality, creating extensive opportunities for renewable energy funds.

Emerging markets in Asia, Latin America, and Africa present high-growth opportunities with excellent solar and wind resources but introduce elevated policy and currency risks. Careful market selection and risk mitigation strategies become critical in these regions. Blended finance structures combining development finance with private capital are gaining traction to de-risk emerging market investments.

🔄 Integration with Portfolio Construction

Financial advisors and institutional investors increasingly recognize renewable energy asset funds as valuable portfolio diversifiers. The low correlation between renewable energy infrastructure returns and traditional equity and fixed income markets provides genuine diversification benefits, potentially reducing overall portfolio volatility while maintaining or enhancing expected returns.

From an asset allocation perspective, renewable energy investments fit within alternatives portfolios alongside infrastructure, real estate, and private equity. Typical institutional allocations to renewable energy range from 2-8% of total portfolios, with larger commitments from investors prioritizing sustainability impact. The illiquidity of private renewable energy funds necessitates appropriate allocation sizing and cash flow planning.

Tax considerations influence optimal fund selection and allocation. Certain fund structures allow pass-through of tax credits and depreciation benefits to investors, enhancing after-tax returns for taxable accounts. Retirement accounts and tax-exempt entities may prefer structures focused on cash yield rather than tax benefits. Consultation with tax advisors ensures optimal structure selection aligned with individual circumstances.

🚀 Innovation Driving Next-Generation Opportunities

The renewable energy sector continues evolving rapidly, creating new investment themes beyond traditional solar and wind. Green hydrogen produced using renewable electricity represents a potentially transformative opportunity for decarbonizing heavy industry, shipping, and aviation. While currently in early commercialization stages, declining electrolyzer costs and supportive policies suggest significant scaling potential.

Energy storage technologies beyond lithium-ion batteries are emerging, including flow batteries, compressed air storage, and thermal storage systems. These technologies address different use cases and duration requirements, expanding the total addressable market for energy storage investments. Funds incorporating diverse storage technologies position themselves to capture opportunities across this evolving landscape.

Distributed energy resources and virtual power plants represent another frontier. Aggregating rooftop solar, batteries, electric vehicles, and controllable loads creates flexible capacity that can provide grid services while delivering value to individual participants. Investment models enabling participation in these distributed architectures are developing, though regulatory frameworks remain works in progress in most jurisdictions.

Digital Technologies Enhancing Asset Management

Advanced technologies are revolutionizing renewable energy asset management and value creation. Predictive maintenance using machine learning algorithms analyzes sensor data to anticipate equipment failures before they occur, reducing downtime and maintenance costs. These systems can improve availability by several percentage points, directly increasing energy production and revenue.

Blockchain technologies enable innovative approaches to renewable energy certificate tracking and peer-to-peer energy trading. While still emerging, these applications promise reduced transaction costs and enhanced transparency in renewable energy markets. Forward-thinking fund managers explore blockchain integration to differentiate offerings and enhance operational efficiency.

Advanced weather forecasting and energy production optimization algorithms allow more accurate prediction of generation patterns and optimal bidding strategies in electricity markets. These capabilities prove particularly valuable for assets selling into merchant markets, where strategic bidding based on accurate forecasts can significantly enhance revenues compared to naive strategies.

🌟 Selecting the Right Renewable Energy Fund

Investors evaluating renewable energy asset funds should consider multiple factors when selecting vehicles aligned with their objectives. Investment strategy clarity proves essential—understanding whether funds focus on development, operational assets, or blended approaches, and whether they target income generation or total return profiles including capital appreciation.

Track record assessment requires examining not only financial performance but also asset management capabilities, development execution, and risk management effectiveness. Funds with experienced teams demonstrating successful project origination, construction management, and asset optimization typically deliver superior risk-adjusted returns compared to less experienced managers.

Fee structures significantly impact net returns over fund lifespans. Management fees typically range from 1-2% of committed or invested capital, while performance fees often follow a “2 and 20” model or variations thereof. Understanding fee structures, hurdle rates, and alignment mechanisms ensures expectations match reality. Lower-fee options including ETFs tracking renewable energy indices offer alternatives for investors prioritizing cost efficiency over active management.

Impact reporting capabilities matter increasingly to investors seeking to demonstrate sustainability credentials. Funds providing comprehensive reporting on carbon emissions avoided, renewable energy generated, and broader ESG impacts enable investors to communicate portfolio sustainability effectively to stakeholders and meet evolving regulatory disclosure requirements.

💡 The Path Forward for Sustainable Energy Finance

Renewable energy asset funds stand at the intersection of compelling financial opportunity and urgent environmental necessity. As the global economy transitions toward sustainable energy systems, these investment vehicles will play an increasingly central role in channeling the trillions of dollars required to build clean energy infrastructure at the scale and pace climate science demands.

The investment case strengthens continuously as renewable technologies advance, costs decline, and policy support solidifies across jurisdictions. Investors recognizing this trajectory and positioning portfolios accordingly stand to benefit both financially and through meaningful contribution to addressing humanity’s defining challenge. The convergence of attractive returns, portfolio diversification benefits, and positive environmental impact creates a rare alignment of financial and ethical imperatives.

For investors seeking exposure to this dynamic sector, careful due diligence, appropriate allocation sizing, and alignment with qualified fund managers prove essential. The renewable energy investment landscape offers opportunities across risk-return spectrums and geographic regions, enabling customization to individual circumstances and preferences. As sustainable finance moves from niche to mainstream, renewable energy asset funds represent not a speculative bet on the future, but a pragmatic response to the energy transition already underway.

The transformation of global energy systems represents one of the largest infrastructure buildouts in human history, creating generational investment opportunities. Renewable energy asset funds provide accessible, professionally managed vehicles for participating in this transition while contributing to a sustainable energy future that benefits both current and future generations.