Anúncios

Tokenization of real-world assets is revolutionizing how investors access, trade, and benefit from traditional investments, creating unprecedented opportunities in global markets.

The financial landscape is undergoing a profound transformation as blockchain technology intersects with traditional asset classes. From real estate and fine art to commodities and intellectual property, the tokenization movement is democratizing access to investments that were once reserved for institutional players and high-net-worth individuals. This shift represents not just a technological evolution, but a fundamental reimagining of ownership, liquidity, and value creation in the digital age.

Anúncios

As we stand at the threshold of this new era, understanding the mechanics, benefits, and implications of asset tokenization becomes essential for anyone looking to navigate the future of investment successfully. The promise is compelling: fractional ownership, 24/7 trading, reduced intermediaries, and global accessibility all wrapped into programmable digital tokens secured by blockchain technology.

🔐 Understanding Real-World Asset Tokenization

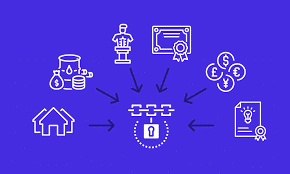

At its core, tokenization is the process of converting rights to an asset into a digital token on a blockchain. These tokens represent ownership or economic interest in tangible or intangible assets, creating a digital certificate of ownership that can be transferred, traded, and verified without traditional intermediaries.

Anúncios

Unlike cryptocurrencies that exist purely in digital form, tokenized real-world assets are backed by actual physical or legal assets. A tokenized property, for example, represents genuine equity in a real building, with all the legal rights and economic benefits that ownership entails. The blockchain simply serves as the ledger recording and facilitating the transfer of these ownership rights.

The technology enables what was previously impossible: dividing expensive assets into smaller, affordable units while maintaining security, transparency, and legal validity. A commercial property worth fifty million dollars can be divided into millions of tokens, each representing a proportional ownership stake, allowing everyday investors to participate in markets traditionally dominated by institutions.

The Technical Foundation 💻

Smart contracts form the backbone of asset tokenization. These self-executing programs automate the enforcement of agreements, distribution of dividends, voting rights, and compliance with regulatory requirements. When predetermined conditions are met, smart contracts automatically execute transactions without human intervention, reducing costs and eliminating potential for disputes.

Different blockchain platforms offer varying capabilities for tokenization. Ethereum remains the dominant platform due to its mature ecosystem and standardized token protocols like ERC-20 and ERC-1400. However, alternatives such as Polygon, Avalanche, and specialized platforms like Polymesh are gaining traction by offering enhanced scalability, lower transaction costs, and built-in compliance features.

📈 Asset Classes Transformed by Tokenization

The tokenization revolution is touching virtually every asset class imaginable, each with unique characteristics and investment propositions that become more accessible through digital representation.

Real Estate: Breaking Down Barriers

Real estate tokenization is perhaps the most compelling use case. Property markets have historically suffered from high entry barriers, illiquidity, and geographical limitations. Tokenization addresses all three challenges simultaneously. Investors can now purchase fractional interests in premium properties across different cities and countries, building diversified real estate portfolios with modest capital.

Beyond accessibility, tokenized real estate offers continuous liquidity. Rather than waiting months to sell a property, token holders can trade their positions on secondary markets at any time. Rental income and property appreciation are automatically distributed to token holders proportionally through smart contracts, creating passive income streams without the headaches of property management.

Art and Collectibles 🎨

The fine art market, traditionally opaque and exclusive, is being democratized through tokenization. Masterpieces worth millions can be fractionalized, allowing art enthusiasts to own shares in works by renowned artists. This not only opens investment opportunities but also creates new funding mechanisms for artists and galleries.

Provenance tracking becomes seamless with blockchain, addressing one of the art world’s most persistent challenges. Every transaction, authentication, and ownership transfer is permanently recorded, reducing fraud and increasing buyer confidence. Digital certificates of authenticity cannot be forged or lost, preserving the integrity of the market.

Commodities and Natural Resources

Tokenization extends to physical commodities like gold, silver, oil, and agricultural products. Investors can hold digital tokens backed by physical reserves stored in secure vaults, gaining exposure to commodity price movements without the complexities of physical storage and insurance.

Carbon credits represent another frontier. As environmental concerns intensify, tokenized carbon credits enable transparent trading of emission offsets, facilitating corporate sustainability goals while creating new investment opportunities in the growing green economy.

Private Equity and Venture Capital

Private company shares have traditionally been locked up for years with limited exit options. Tokenization introduces liquidity to private markets, allowing early investors and employees to monetize portions of their holdings before traditional exit events. This enhanced liquidity can attract more capital to innovative startups and growth-stage companies.

Security token offerings (STOs) enable companies to raise capital globally while maintaining regulatory compliance. Unlike initial coin offerings, STOs represent actual ownership stakes with legal protections, bridging the gap between traditional finance and blockchain innovation.

🌟 Compelling Advantages for Modern Investors

The tokenization of real-world assets delivers transformative benefits that extend beyond mere digitization, fundamentally altering the investment value proposition across multiple dimensions.

Fractional Ownership and Accessibility

Perhaps the most democratizing aspect of tokenization is fractional ownership. Assets that required millions in capital become accessible with investments as small as hundreds of dollars. This lowers barriers to entry dramatically, enabling portfolio diversification previously available only to wealthy investors.

Geographic boundaries dissolve in tokenized markets. An investor in Brazil can easily hold tokens representing London real estate, Dubai hotels, and Manhattan commercial properties, all from a single digital wallet. This global accessibility creates truly international investment opportunities without the traditional complexities of cross-border transactions.

Enhanced Liquidity 💧

Illiquidity has long been the curse of alternative investments. Real estate, private equity, and fine art can take months or years to sell. Tokenization transforms illiquid assets into tradeable securities that can be bought and sold on secondary markets around the clock.

This liquidity premium increases asset values. Investors willingly pay more for assets they can exit quickly, potentially boosting returns for early adopters. Market efficiency improves as price discovery becomes continuous rather than sporadic.

Transparency and Security

Blockchain’s immutable ledger provides unprecedented transparency. Every token transaction is permanently recorded and publicly verifiable, reducing fraud and increasing trust. Ownership records cannot be disputed or altered, eliminating common sources of conflict in traditional markets.

Smart contracts enforce compliance automatically, ensuring regulations are followed without manual oversight. Know Your Customer (KYC) and Anti-Money Laundering (AML) checks can be embedded directly into tokens, with trading restrictions programmed at the protocol level.

Reduced Costs and Intermediaries

Traditional asset transactions involve numerous intermediaries: brokers, lawyers, banks, clearinghouses, and custodians. Each adds cost and time to transactions. Tokenization disintermediates these processes, with smart contracts automating functions previously requiring human involvement.

Settlement times shrink from days or weeks to minutes. Transaction costs plummet as blockchain networks charge minimal fees compared to traditional financial intermediaries. These savings compound over time, significantly improving net returns for investors.

🚧 Navigating Challenges and Considerations

Despite its transformative potential, asset tokenization faces meaningful challenges that must be addressed for mainstream adoption to occur. Understanding these obstacles helps investors make informed decisions and manage expectations realistically.

Regulatory Uncertainty

The regulatory landscape for tokenized assets remains fragmented and evolving. Different jurisdictions apply varying frameworks, creating complexity for global platforms. Security token offerings must navigate securities laws in each market they operate, requiring sophisticated legal expertise.

Regulatory clarity is improving gradually. The European Union’s Markets in Crypto-Assets (MiCA) regulation provides comprehensive framework, while jurisdictions like Singapore and Switzerland have developed token-friendly regulatory environments. However, harmonization across borders remains incomplete, creating compliance challenges for cross-border offerings.

Technical and Infrastructure Limitations ⚙️

Blockchain scalability continues to improve but hasn’t reached the throughput levels of traditional financial infrastructure. During periods of high network activity, transaction costs can spike and confirmation times increase, potentially hindering user experience.

Custody solutions for tokenized assets require specialized infrastructure combining blockchain expertise with traditional asset security. The industry is still developing best practices for key management, disaster recovery, and institutional-grade custody that meets regulatory standards.

Market Maturity and Liquidity

While tokenization promises enhanced liquidity, secondary markets for tokenized assets are still developing. Trading volumes remain modest compared to traditional markets, meaning large positions might still be difficult to exit quickly without price impact.

Valuation methodologies for tokenized assets are evolving. Without extensive historical data and standardized appraisal methods, pricing can be uncertain, particularly for unique assets like rare art or specialty real estate.

Legal and Ownership Complexities

The legal connection between digital tokens and underlying assets requires careful structuring. Bankruptcy, jurisdictional issues, and asset recovery in case of disputes need clear legal frameworks that vary by asset type and location.

Smart contract bugs or exploits pose risks. While blockchain itself is secure, vulnerabilities in smart contract code can be exploited, potentially leading to loss of funds. Thorough auditing and formal verification methods are essential but add development time and costs.

🔮 The Investment Landscape of Tomorrow

Looking ahead, the tokenization of real-world assets will likely become standard practice rather than innovative exception. Several trends are shaping this future, creating opportunities for forward-thinking investors.

Institutional Adoption Accelerating

Major financial institutions are moving beyond experimentation to deployment. JPMorgan, Goldman Sachs, and Fidelity have launched tokenization initiatives. BlackRock has invested in infrastructure for tokenized securities. This institutional validation brings credibility, capital, and expertise that will accelerate market development.

Central bank digital currencies (CBDCs) will likely integrate with tokenized asset ecosystems, creating seamless pathways between traditional and tokenized finance. This interoperability will reduce friction and broaden participation.

Artificial Intelligence Integration 🤖

AI and machine learning will enhance tokenized asset investing through improved valuation models, risk assessment, and portfolio optimization. Predictive analytics can identify undervalued tokenized assets, while automated trading strategies can exploit market inefficiencies across global tokenized markets.

Smart contracts will become more sophisticated, incorporating AI-driven decision-making for dynamic asset management, automated rebalancing, and adaptive compliance mechanisms that respond to changing regulations in real-time.

Expanding Asset Universe

The types of assets being tokenized will expand dramatically. Intellectual property, music royalties, patent portfolios, and revenue streams from businesses will become tradeable tokens. Personal assets like car equity and home equity lines may be tokenized, creating new forms of collateral and financing.

Sustainability-linked tokens will proliferate as environmental, social, and governance (ESG) considerations become central to investment decisions. Green bonds, sustainable infrastructure projects, and impact investments will leverage tokenization for transparency and accountability.

💼 Strategic Approaches for Investors

For investors looking to participate in the tokenization revolution, strategic approaches can maximize opportunities while managing risks effectively in this evolving landscape.

Education and Due Diligence

Understanding blockchain fundamentals, smart contract functionality, and regulatory frameworks is essential. Investors should evaluate platforms based on their technology stack, security audits, regulatory compliance, and team expertise before committing capital.

Analyzing the underlying assets remains paramount. A tokenized asset is only as valuable as what it represents. Traditional investment analysis applies: cash flows, growth potential, competitive positioning, and macroeconomic factors all matter regardless of tokenization.

Portfolio Integration

Tokenized assets should complement rather than replace traditional investments. Gradual allocation allows investors to gain experience while limiting exposure to market immaturity and regulatory uncertainty. Diversification across asset classes, geographies, and platforms reduces concentration risk.

Consider tokenized assets as access vehicles to otherwise unavailable investments rather than speculative instruments. The value proposition lies in accessing quality assets with improved liquidity and lower minimums, not chasing unrealistic returns.

Platform Selection Criteria 🎯

Choose platforms with strong regulatory compliance, transparent operations, and robust security measures. Look for third-party audits, insurance coverage, and clear legal structures connecting tokens to underlying assets. Established platforms with track records and institutional backing generally offer lower risk profiles.

Evaluate liquidity provisions realistically. Secondary market volumes, market maker participation, and redemption mechanisms should be verified. Platforms offering guaranteed liquidity or buyback provisions may reduce liquidity risk but potentially at the cost of reduced returns.

🌐 Global Perspectives and Regional Developments

The tokenization movement is advancing at different paces globally, with regional variations in regulatory approaches, market maturity, and adoption rates creating a diverse international landscape.

Asia-Pacific markets, particularly Singapore and Hong Kong, are emerging as tokenization hubs due to progressive regulatory frameworks and strong technological infrastructure. Switzerland’s crypto valley continues attracting tokenization projects with clear legal guidelines and supportive government policies.

The United States market, while largest in potential, faces regulatory complexity with overlapping federal and state jurisdictions. Recent regulatory clarity from the SEC regarding digital asset securities is gradually creating pathways for compliant tokenization offerings.

Emerging markets see tokenization as leapfrog opportunity, bypassing legacy financial infrastructure to build blockchain-native investment ecosystems. Latin America, Africa, and Southeast Asia are experimenting with tokenized real estate and agricultural assets to address financial inclusion challenges.

🎯 Realizing the Transformative Potential

The tokenization of real-world assets represents more than technological innovation; it embodies a fundamental reimagining of ownership, value transfer, and economic participation in the digital age. As technical capabilities mature, regulatory frameworks solidify, and institutional adoption accelerates, tokenization will transition from emerging trend to established infrastructure.

For investors, the opportunity lies not in speculative trading but in accessing quality assets previously beyond reach, building diversified portfolios with enhanced liquidity, and participating in markets with improved transparency and reduced costs. The democratization of investment through tokenization can create more inclusive financial systems where geographic location and wealth levels present fewer barriers to opportunity.

Success in this evolving landscape requires balanced perspective: enthusiasm for innovation tempered with prudent risk management, technological understanding combined with fundamental investment discipline, and openness to new possibilities grounded in realistic expectations. Those who navigate this balance thoughtfully position themselves to benefit from one of the most significant shifts in investment infrastructure in generations.

The future of investment is being written today in lines of code, smart contracts, and digital tokens. By understanding the mechanics, recognizing the opportunities, acknowledging the challenges, and acting strategically, investors can unlock value in ways previously unimaginable, participating in the transformation of global capital markets from the ground floor.