Anúncios

Corporate sustainability ratings have become a powerful catalyst for transforming how businesses operate, innovate, and create lasting value for stakeholders and the planet.

In an era where environmental consciousness and social responsibility are no longer optional extras but essential business imperatives, companies worldwide are discovering that sustainability ratings serve as both compass and accelerator. These comprehensive assessments evaluate corporate performance across environmental, social, and governance (ESG) dimensions, providing stakeholders with transparent insights into how businesses truly operate beyond profit margins.

Anúncios

The transformation happening in boardrooms across the globe reflects a fundamental shift in capitalism itself. Sustainability ratings have emerged as critical tools that influence investment decisions, consumer choices, regulatory compliance, and competitive positioning. Understanding how these ratings drive positive change while simultaneously enhancing business success has become essential for any organization seeking long-term viability in today’s interconnected economy.

🌍 The Rising Influence of Sustainability Ratings in Modern Business

Corporate sustainability ratings have evolved from niche reporting mechanisms to mainstream business essentials that command attention from CEOs, investors, and policymakers alike. Organizations like MSCI, Sustainalytics, CDP, and S&P Global provide comprehensive assessments that evaluate thousands of companies on their environmental impact, labor practices, community engagement, and governance structures.

Anúncios

The financial markets have responded dramatically to this transparency revolution. According to recent data, sustainable investment assets now exceed $35 trillion globally, representing more than one-third of total managed assets. Institutional investors increasingly integrate ESG ratings into their decision-making processes, recognizing that sustainability performance correlates strongly with risk management capabilities and long-term financial returns.

This shift reflects broader societal expectations. Consumers, particularly millennials and Gen Z, actively research corporate sustainability credentials before making purchasing decisions. Employees seek employers whose values align with their own, making sustainability credentials crucial for talent attraction and retention. Regulators worldwide are implementing disclosure requirements that make sustainability reporting mandatory rather than voluntary.

📊 How Sustainability Ratings Actually Work

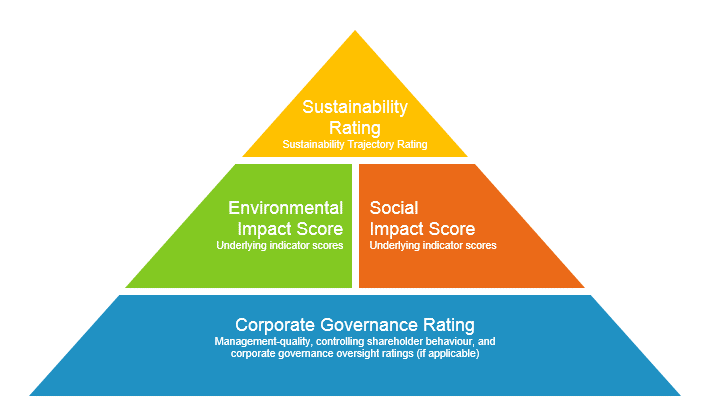

Understanding the mechanics behind sustainability ratings illuminates why they’ve become such powerful change agents. Rating agencies employ sophisticated methodologies that examine hundreds of data points across multiple dimensions. These assessments typically evaluate carbon emissions, water usage, waste management, supply chain practices, diversity policies, community investment, executive compensation, board composition, and transparency practices.

The assessment process combines quantitative metrics with qualitative analysis. Companies submit detailed disclosures through frameworks like the Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosures (TCFD), or Sustainability Accounting Standards Board (SASB). Rating agencies then verify this information through third-party data, stakeholder interviews, media analysis, and regulatory filings.

What makes these ratings particularly impactful is their comparability. By standardizing assessment criteria across industries and geographies, sustainability ratings enable investors and stakeholders to benchmark performance, identify leaders and laggards, and track progress over time. This transparency creates accountability mechanisms that drive continuous improvement.

Key Components Evaluated in Comprehensive Sustainability Ratings

- Environmental Performance: Carbon footprint, renewable energy adoption, water stewardship, biodiversity protection, and circular economy initiatives

- Social Responsibility: Labor standards, workplace safety, diversity and inclusion, community relations, and human rights throughout the value chain

- Governance Excellence: Board independence, executive compensation alignment, shareholder rights, business ethics, and anti-corruption measures

- Risk Management: Climate change adaptation, supply chain resilience, cybersecurity protocols, and stakeholder engagement processes

- Innovation and Leadership: Sustainable product development, industry collaboration, policy advocacy, and transparency in reporting

💡 The Business Case for Sustainability Excellence

The relationship between sustainability ratings and business success extends far beyond reputation management. Research consistently demonstrates that companies with superior ESG ratings outperform their peers across multiple business metrics, creating a compelling financial argument for sustainability investment.

Operational efficiency represents one immediate benefit. Companies pursuing higher sustainability ratings identify opportunities to reduce resource consumption, minimize waste, and optimize energy usage. These improvements translate directly into cost savings while simultaneously reducing environmental impact. Organizations like Unilever have documented billions in cost reductions through sustainability-driven operational improvements.

Access to capital has become increasingly dependent on sustainability credentials. Major financial institutions now offer preferential lending rates for companies with strong ESG ratings, while sustainability-linked bonds and loans tie interest rates to achievement of specific sustainability targets. Companies with poor ratings face higher borrowing costs and may find themselves excluded from major investment funds.

Revenue Growth Through Sustainability Leadership

Strong sustainability ratings unlock revenue opportunities that would otherwise remain inaccessible. Consumer brands with credible sustainability credentials command premium pricing and enjoy stronger customer loyalty. B2B companies increasingly find that sustainability ratings determine supplier qualification, with major corporations requiring specific ESG standards throughout their supply chains.

Innovation acceleration represents another significant advantage. The pursuit of sustainability excellence drives companies toward circular business models, sustainable materials research, and clean technology adoption. These innovations create competitive advantages while opening entirely new market opportunities in the rapidly expanding green economy.

🔄 How Ratings Drive Organizational Transformation

The true power of sustainability ratings lies not in the scores themselves but in the transformation processes they catalyze within organizations. When companies commit to improving their ratings, they initiate comprehensive change programs that touch every aspect of operations.

Leadership alignment becomes essential. Sustainability excellence requires C-suite commitment, with many leading companies now tying executive compensation to ESG performance metrics. This alignment ensures that sustainability considerations integrate into strategic planning rather than remaining isolated in corporate responsibility departments.

Cross-functional collaboration intensifies as organizations recognize that sustainability challenges transcend departmental boundaries. Supply chain teams collaborate with procurement on responsible sourcing, operations work with finance on green investments, and human resources partner with legal on governance improvements. This integration breaks down silos while building organizational capabilities.

Data infrastructure and measurement systems undergo significant upgrades. Accurate sustainability reporting requires robust systems for tracking energy consumption, emissions, diversity metrics, and countless other indicators. Companies invest in technology platforms that enable real-time monitoring, automated reporting, and predictive analytics for sustainability performance.

🌟 Real-World Success Stories and Impact Evidence

Examining concrete examples illustrates how sustainability ratings translate into tangible business benefits and positive environmental and social outcomes. Companies across industries have demonstrated that sustainability excellence and business success reinforce rather than conflict with each other.

Microsoft has achieved carbon neutrality while maintaining industry-leading profitability, committing to become carbon negative by 2030. Their sustainability leadership has enhanced brand reputation, attracted top talent, and positioned them favorably with enterprise clients increasingly prioritizing sustainable technology partners. Their strong ESG ratings have contributed to their position as one of the world’s most valuable companies.

Ørsted transformed from a fossil fuel-dependent utility into the world’s leading offshore wind developer. This radical business model transformation, driven partly by sustainability imperatives, has delivered exceptional shareholder returns while dramatically reducing carbon emissions. Their journey demonstrates how sustainability-driven reinvention can create rather than destroy shareholder value.

Patagonia has built an entire business model around sustainability leadership, earning top ratings while achieving consistent growth and profitability. Their commitment to environmental and social responsibility has created fierce customer loyalty and differentiation in competitive markets. They prove that authenticity in sustainability commitments resonates powerfully with stakeholders.

⚠️ Challenges and Criticisms in the Rating Ecosystem

Despite their growing influence, sustainability ratings face legitimate criticisms that organizations must navigate carefully. Understanding these limitations helps companies use ratings effectively while avoiding potential pitfalls.

Methodological inconsistencies across rating agencies create confusion. The same company may receive vastly different scores from different agencies due to varying assessment criteria, weighting systems, and data sources. This lack of standardization complicates decision-making for investors and creates uncertainty for companies seeking to improve performance.

Greenwashing concerns persist as some organizations prioritize appearance over substance, investing more in sustainability marketing than actual performance improvement. Rating agencies continually refine methodologies to distinguish genuine commitment from superficial efforts, but sophisticated greenwashing can still mislead stakeholders.

Data availability and quality issues particularly affect smaller companies and emerging markets. Comprehensive sustainability reporting requires significant resources, potentially disadvantaging organizations that lack dedicated ESG teams. Rating agencies are working to improve accessibility while maintaining rigor in their assessments.

Addressing the Limitations Through Continuous Improvement

The sustainability rating ecosystem is evolving rapidly to address these challenges. Industry initiatives are working toward greater standardization, with regulatory bodies in Europe, North America, and Asia developing harmonized disclosure requirements. Technology solutions including artificial intelligence and blockchain are improving data collection, verification, and analysis.

Companies can navigate these challenges by focusing on genuine performance improvement rather than rating optimization. Organizations that embed sustainability into core strategy, engage authentically with stakeholders, and maintain transparency in both successes and setbacks build credibility that transcends any individual rating score.

🚀 Leveraging Ratings for Strategic Advantage

Forward-thinking organizations recognize that sustainability ratings offer strategic intelligence that extends beyond compliance or risk management. These assessments provide competitive benchmarking, identify improvement opportunities, and guide resource allocation toward highest-impact initiatives.

Materiality assessments become more sophisticated when informed by rating methodologies. Companies can identify which sustainability issues matter most to their stakeholders and business model, focusing efforts where they’ll generate greatest impact. This strategic focus prevents diffusion of resources across too many initiatives while ensuring attention to truly critical issues.

Stakeholder engagement deepens when companies transparently communicate sustainability performance using credible third-party ratings. Investors appreciate the comparability and rigor that established rating frameworks provide. Customers gain confidence in sustainability claims backed by independent verification. Employees feel pride in working for recognized sustainability leaders.

Supply chain management becomes more effective when sustainability ratings inform supplier selection and development. Leading companies cascade sustainability requirements throughout their value chains, using rating frameworks to establish clear expectations and track supplier performance. This approach multiplies impact far beyond direct operations.

🔮 The Future Landscape of Corporate Sustainability Assessment

The evolution of sustainability ratings continues accelerating as stakeholder expectations rise and assessment methodologies become increasingly sophisticated. Several trends are shaping the future landscape that organizations must anticipate.

Regulatory mandates are expanding globally, transforming voluntary sustainability reporting into legal requirements. The European Union’s Corporate Sustainability Reporting Directive establishes comprehensive disclosure obligations for thousands of companies. Similar regulations are emerging across major economies, creating convergence toward standardized, mandatory sustainability reporting.

Technology integration is revolutionizing data collection and verification. Satellite imagery tracks deforestation and emissions, artificial intelligence analyzes vast quantities of unstructured data, and blockchain enables transparent supply chain tracking. These technological advances reduce reporting burdens while improving accuracy and reducing greenwashing opportunities.

Impact measurement is moving beyond activities and outputs toward actual outcomes. Rather than simply tracking charitable donations or volunteer hours, next-generation ratings will assess genuine social and environmental impact. This evolution reflects stakeholder demand for evidence that corporate sustainability efforts create measurable positive change.

🎯 Building Sustainability Excellence Into Organizational DNA

Achieving and maintaining high sustainability ratings requires more than periodic reporting exercises. Leading organizations embed sustainability considerations throughout culture, systems, and decision-making processes, making it an intrinsic part of how they operate rather than an additional compliance burden.

Cultural transformation begins with clear communication of sustainability values from leadership, reinforced through recognition systems, performance management, and daily operations. When employees throughout the organization understand how their roles contribute to sustainability objectives, initiative and innovation flourish organically.

Systems integration ensures sustainability data flows seamlessly into business intelligence platforms, enabling real-time monitoring and data-driven decision-making. Financial systems incorporate carbon pricing and environmental costs, procurement platforms flag sustainability risks, and strategic planning processes systematically evaluate ESG implications.

Continuous learning and adaptation enable organizations to stay ahead of evolving expectations and emerging best practices. Companies establish feedback loops that capture insights from rating assessments, stakeholder engagement, and competitive benchmarking, translating these learnings into ongoing improvement initiatives.

The journey toward sustainability excellence represents neither a destination nor a cost center but rather an ongoing process of value creation. Corporate sustainability ratings serve as valuable navigation tools on this journey, providing transparency, accountability, and comparability that drive continuous improvement. Organizations that embrace these assessments as strategic opportunities rather than compliance obligations position themselves for long-term success in an economy increasingly defined by sustainability imperatives.

As stakeholder expectations continue rising and environmental and social challenges intensify, the business case for sustainability excellence will only strengthen. Companies that build genuine sustainability capabilities, demonstrate them through credible ratings, and authentically engage stakeholders will thrive in the emerging economy. Those that resist or superficially respond will find themselves increasingly marginalized as capital, customers, and talent flow toward organizations proving that purpose and profit can successfully coexist. 🌱