Mastering Geopolitical Investment Risks

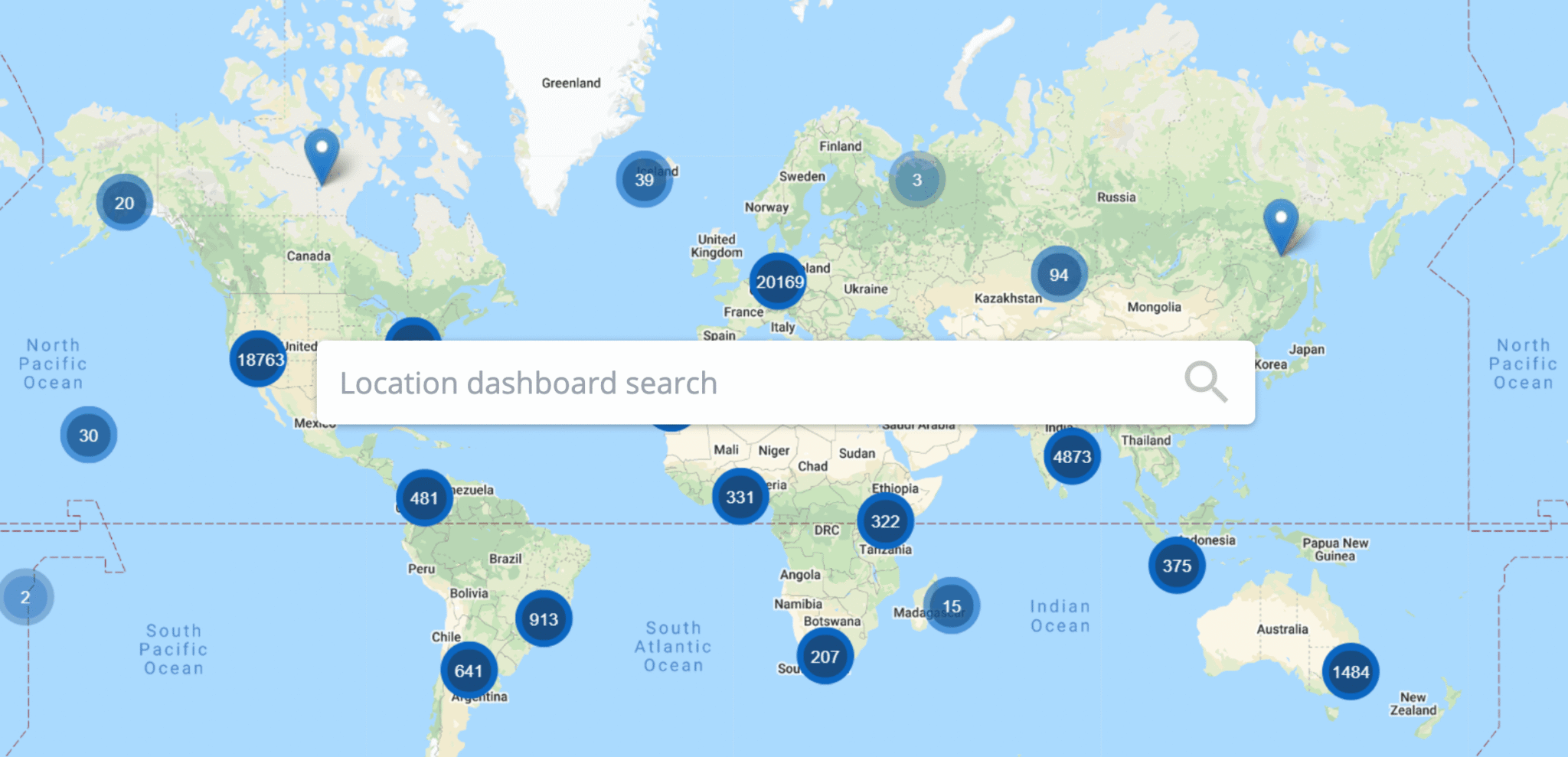

In today’s interconnected world, global investments face unprecedented challenges from geopolitical tensions, regulatory shifts, and international conflicts that can rapidly reshape market landscapes. 🌍 Understanding the Modern Geopolitical Landscape Geopolitical risks have evolved dramatically over the past decade, transforming from occasional disruptions into constant considerations for investors worldwide. The interconnected nature of modern economies means … Read more